When it comes to real estate, you should never put too much trust in any one thing, be it the online property value of a home, or the market trends of a whole city. Real estate anywhere, in Chicago or Charleston, requires interpretation. By default, you should not trust the online property value of a home, but you shouldn’t disregard it entirely either. Let’s go into when and why you should consider the online property value, but why you shouldn’t trust it in the long run.

How Do Online Property Values Work?

Pretty much every real estate listing website uses something called Automated Valuation Models (AVMs) to come up with online property values. These models are algorithms that take data from the public record (home sales, bedrooms, square footage, you name it) and make comparisons from that data to arrive at the online property values that you see on sites like Zillow. On paper and in a perfect world, these algorithms work very well in coming up with logical prices that actually reflect the realities of the real estate market.

Incomplete or Inaccurate Data

However, in the real world, AVMs fall short more often than not for a number of reasons. For one thing, the data about home sales, bedroom numbers, square footage, home qualities, everything, is usually not complete. If the data that a model uses is incomplete, the conclusions you can draw from that model are also going to be incomplete.

This isn’t the model’s fault, but the fault of all the public and private institutions whose job it is to collect that data in the first place. Every real estate market is different from the last. Information commonly collected in one market is not commonly collected in another, or at the same rate.

A Lack of Housing Data

For large urban areas with a ton of homes that don’t differ too much between each other, AVMs typically give decent online property values. They have a large data pool where the main difference between most of the properties is purely price. When you start getting into markets with a wider variety of housing, or with a smaller amount of housing, or both, the model either doesn’t have enough data to draw a good conclusion from, or the data is different and diverse that the results aren’t worth relying on.

A Lag in Timing

The biggest problem with trusting the online property value of a house has less to do with the source and quality of the data, but the time at which that data is processed. When AVMs collect data about home sales, they’re collecting that data starting at the time it’s put into the public register, which can be weeks or months after the house was sold. So even if you had all the data possible about a real estate market, and you got an absolutely perfect model of a housing market to base your online property values on, those prices would be out-of-date. You’d be trusting old information.

The Good And Bad Of Online Property Values

Putting all your trust in the online property value of a home would be like building a house with just a hammer. On their own, online property values are good for surface level judgements on a housing market, but if you want to go deeper you’ll need to find more up-to-date data. The best way to do that is to use a real estate agent.

Perks to Using A Real Estate Agent Instead

If you ask the right questions to find the right real estate agent, you’ll be getting all the great analysis of an AVM in a living breathing person who knows the real estate market as it is today and not as it was two months ago. A good real estate agent will make all the same comparisons and analyses as an AVM in addition to knowing their market intimately and professionally, with more complete information at their disposal. For instance, most AVMs can’t factor “the vibe” of a neighborhood into property value, while a real estate agent can.

Using the online property value in a large market with lots of the same type of housing along with a real estate agent is a great idea, but trusting the online property value on its own will keep you ten steps behind all the other buyers and sellers in your market. You’re more liable to lose out on the home of your dreams by using data that’s a month out of date, than if you used an agent who updates themselves on their local market every single day.

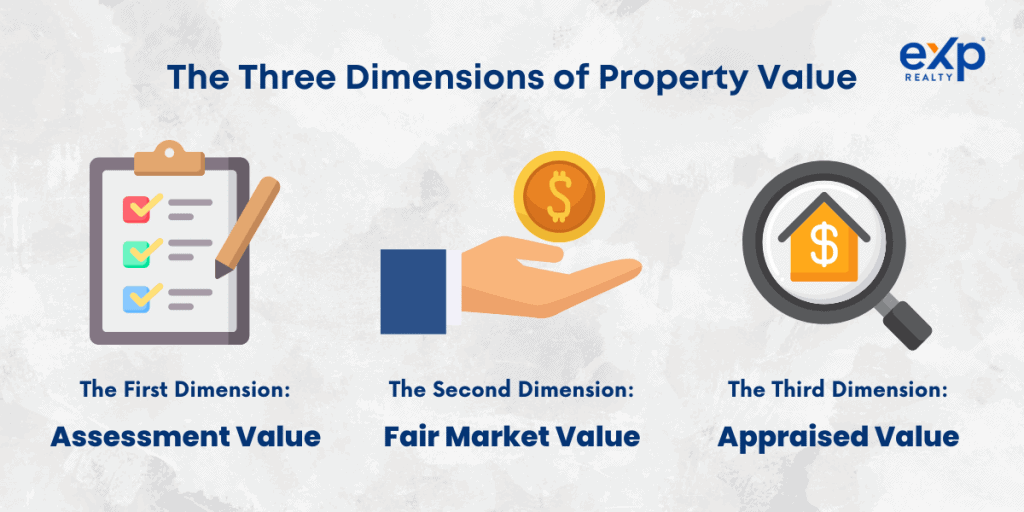

How Do You Determine The Actual Value Of Property?

We know about AVMs, but do we know what they’re actually trying to model? What actually is property value? Property value sounds like it would be straightforward i.e. it’s the value of your property, the worth in it. But in reality, property value is a combination of three different worths each calculated by different people for different reasons. In short, property value is three dimensional, but to “see it” you have to take each dimension one at a time.

The Three Dimensions of Property Value

The First Dimension: Assessment Value

The assessment value of your home is how much the property is worth for tax purposes. When the IRS wonders how much your home should be taxed, this is the value that they care about. Your assessment value is determined by a tax assessor who works within a specific zone to which your home belongs. The assessor mostly factors in the fair market value of your home (which we’ll get to soon) to determine how much you will be taxed.

If you’re interested in a particular home for sale, figure out its assessed value and you’ll have an idea of what your property taxes will be. It’s worth noting though that homes regularly get reassessed for tax purposes, so your assessed value can change from time to time depending on where you live.

The Second Dimension: Fair Market Value

The fair market value is the keystone of your home’s worth. Technically, the fair market value of your home is how much it could sell for if you put it on the market. There’s an uncertainty intrinsic to fair market value, the value could be anything. If you put your $500K house on the market, and it sold for $440K, then $440K is the fair market value. The assumption here is that what the buyers in a market are willing to pay should take precedence over almost all other values. This puts a lot of power in the buyer’s hands.

When you look for a house and see that the online property value of a home is $330K, that’s a suggestion of what the seller thinks the fair market value should be. It’s up to you, the buyer, to decide if their suggestion has any weight. When you buy that house, you’ve solidified the fair market value, but the moment after you’ve bought it, fair market value becomes uncertain until someone else buys it.

The Third Dimension: Appraised Value

Sometimes the fair market value gets it wrong and overvalues the true worth of a house. Lenders keep this in mind, and so when they lend money out to home buyers they send an appraiser to the home in question to see if the place is actually worth how much money they’re lending out for it.

When you get a mortgage with a lender, you’re borrowing some portion of the fair market value of the house. In the event that you can’t pay your mortgage, the lender can then take your home, sell it, and make their money back. They can’t make their money back if the actual value of the house (their appraised value) does not line up with the fair market value. The lender can never be certain if the fair market value won’t fall in the future, which is partly why borrowers pay interest to compensate the lender for their risk.

So, in effect, the appraised value is basically the lender double-checking the fair market value of your home. Because almost every home is bought with a loan, almost every home is appraised by a professional appraiser, and most of the time this helps regulate home values and reign in overvaluing.

Should I Trust The Online Property Value of A Home?

Now that you’ve seen that property value is reliant on what people are willing to pay for said property today, solely relying on data that is weeks out of date is a bad idea. Online property values might give you a good idea of the big picture of a specific market, but if you’re trying to get any deeper, you need to work with a real estate agent who knows the current market, and not an algorithm which knows the incomplete market of the past.