Are you looking to make an offer on a house but don’t know where to start? Don’t worry, making an offer on a house is easier than it sounds. From researching the market and getting pre-approved for a mortgage, to finding the right real estate agent and finalizing the deal – we’ll take you through all of these crucial steps so that you can confidently make your move.

With our advanced level of professional advice and increased randomness, let us guide you through this process with ease before buying a real estate for sale in Florida or anywhere in the US. Read our catch all guide to learn how to make an offer on a house in 5 simple steps today.

1. Research the Market

Before making an offer on a house, it is essential to thoroughly research the local market and familiarize oneself with relevant regulations. It’s important to analyze comparable properties in the area and understand local regulations before making an offer on a house. By researching ahead of time, one can avoid potential pitfalls and reap the rewards in the future.

Analyzing Comparable Properties

Start by looking at similar houses that have recently sold or are currently listed for sale nearby. Examining analogous dwellings that have been sold or are on the vicinity’s competitive market can help you gauge what cost range is realistic when putting forward a bid. When making an offer, other considerations like state, dimensions, spot, and features should be taken into account to decide on a suitable price.

Understanding Local Regulations

Researching local zoning laws and building codes can help ensure that any improvements or renovations you plan to make comply with city ordinances. Additionally, understanding these regulations can provide valuable insight into how much value potential upgrades may add to your home over time.

Before purchasing a residence, it is wise to investigate what kind of protection is accessible in your locality to ensure you are sufficiently safeguarded against unexpected occurrences like fires or inundations. It is advisable to shop around for competitive rates from multiple insurance providers before selecting one policy over another as every penny counts.

Researching the market is an essential step in making a successful offer on a house. Gaining pre-approval for financing can aid in comprehending financial allowance and loan prospects, as well as formulating practical expectations when proposing an offer.

2. Get Pre-Approved for a Mortgage

Gathering necessary financial documents and consulting a lender to understand one’s budget and loan options are key steps when pre-approving for a mortgage before making an offer on a house.

Gather the requisite financial records beforehand to ensure a speedy approval time, such as tax returns from the past two years, bank statements, pay stubs, or other proof of income, and any assets like investments or real estate holdings.

Gather two years’ worth of tax returns, financial statements, income evidence, and any other property or investments you may possess for the loan application process to go quickly. Having these documents handy will make the process much smoother and speed up approval time.

Find a Lender and Get Pre-Approved

Once you’ve gathered all of your financial paperwork, it’s time to find a mortgage lender who can help you with getting pre-approved for a mortgage loan. Shop around for different lenders to compare rates and terms before settling on one that fits your needs best. Be ready to respond to queries regarding your credit score and job status when filling out the application with a lender, so they can decide how much money to lend you based on those elements.

Once pre-approved by the lender, it is essential to comprehend what type of loan best suits both immediate and long-term objectives when purchasing the property. Staying within budget while also preparing for potential renovations or expansions down the line requires careful consideration. Selecting a loan option that meets current lifestyle requirements yet still allows room for adjustments in monthly payments due or interest rates charged depending on market conditions over time is key.

Before committing to a home purchase, it is beneficial to obtain pre-approval for a mortgage loan. Once pre-approval is secured, it’s time to start searching for a realtor who can aid in locating the ideal abode.

3. Find a Real Estate Agent

Discovering the correct real estate representative is a crucial step when purchasing a home. Interviewing agents to find the perfect fit can be daunting, but it’s worth taking your time to ensure you have the best representation when making an offer on a property.

Always work with a licensed real estate agent. Not only are they professionals at buying and selling properties, they have connections with all kinds of other people and services you’ll need as you move through the process- including lawyers, home inspectors, and even mortgage companies! eXp can help you find the agent of your dreams.

You can also look at local Facebook groups for homeowners, ask friends and family for recommendations, or contact a local real estate agency near you.

When interviewing agents, look for someone who has experience in the local market and is knowledgeable about comparable properties and current regulations. Enquire about their specialty areas and years of experience, and consider recommendations from those familiar with a particular agent.

Once you’ve opted for a realtor, ensure they are cognizant of your aims and objectives so that they can effectively convey them in conversations with vendors. Discuss things like budget constraints, desired features of a home, timeline for purchase, and any other specific requests that are important to you.

This will help them narrow down potential homes within your price range while still meeting all of your needs. Additionally, ask what their strategy is for negotiating with sellers so that there aren’t any surprises along the way.

Your real estate agent plays an essential role throughout the process of buying a house – from researching comparable properties and understanding local regulations to helping negotiate terms of offers with sellers.

Therefore, it is essential to ensure that you select an agent who meets your needs and understands the type of house you are seeking. With careful research into potential agents combined with clear communication about goals and expectations up front, first-time buyers can rest assured knowing they have trusted representation in every step of purchasing their dream home.

Locating a suitable property representative is vital to submit an offer on a residence. Step 4: Now’s the time to put forth an offer on your ideal abode.

Finding the right real estate agent is essential to making an offer on a house; take your time to ensure you have the best representation by interviewing agents, getting referrals, and communicating clearly about expectations. With careful research and communication up front, buyers can trust they have reliable support throughout their home-buying journey.

4. Finalize and Submit Your Offer

Before making an offer on a house, it is essential to research the seller’s desired price point and use that information to craft a competitive bid. This is where your agent will come in- they can communicate with the seller’s agent and draft the official offer for you. The offer will include the price you are offering for the home, as well as your name and current address. It will also include some negotiation terms.

Research the neighborhood you want to live in when deciding how much to offer for your potential home. Consider what other homes have sold for recently, as well as their features compared to the home you’re interested in. Look into any potential renovations or upgrades that may need to be done and factor those costs into your offer price. Once you have all of this information, use it to make an educated guess about how much the seller will accept from you.

Negotiation terms list contingencies of closing on your home, including loan approval (financing contingency), inspection results (inspection contingency), appraisal value being met (appraisal contingency), and title search passing without issue. Make sure these items are clearly outlined in your purchase agreement so that both parties understand what must happen before the closing process can take place and who will bear responsibility for any issues that arise during this time.

Negotiating terms of the offer with the seller is key when making an offer on a house; don’t just accept whatever they propose. If there’s something specific that needs attention like replacing broken appliances or fixing a leaky roof, try negotiating those items separately rather than including them as part of your initial bid amount so they don’t affect negotiations over final cost too much.

You may also want to consider offering incentives such as paying closing costs or providing additional earnest money deposits which could sweeten up your deal enough for them to accept it over another buyer’s competing bid but remember not to get carried away here either.

Creating a bid for a residence can be intimidating, but with the right groundwork and study, it doesn’t need to be. Now that you’ve made your offer, it’s time to finalize the deal by signing contracts and submitting earnest money deposits.

5. Finalize the Deal

Once you’ve identified the ideal home, it’s time to make the transaction official. This includes signing contracts and submitting an earnest money deposit, completing a home inspection and appraisal, and securing final mortgage approval.

Signing Contracts and Submitting Earnest Money Deposit: When making an offer on a house, contracts are drawn up between the buyer and seller that outline all of the terms of the sale. Once both parties agree to these terms, they sign the contract which legally binds them to its contents.

The buyer must also submit an earnest money deposit with their offer as proof of good faith that they intend to follow through with purchasing the property. The buyer typically provides a sum of 1-3% of the purchase price as an earnest money deposit, although this can be subject to negotiation.

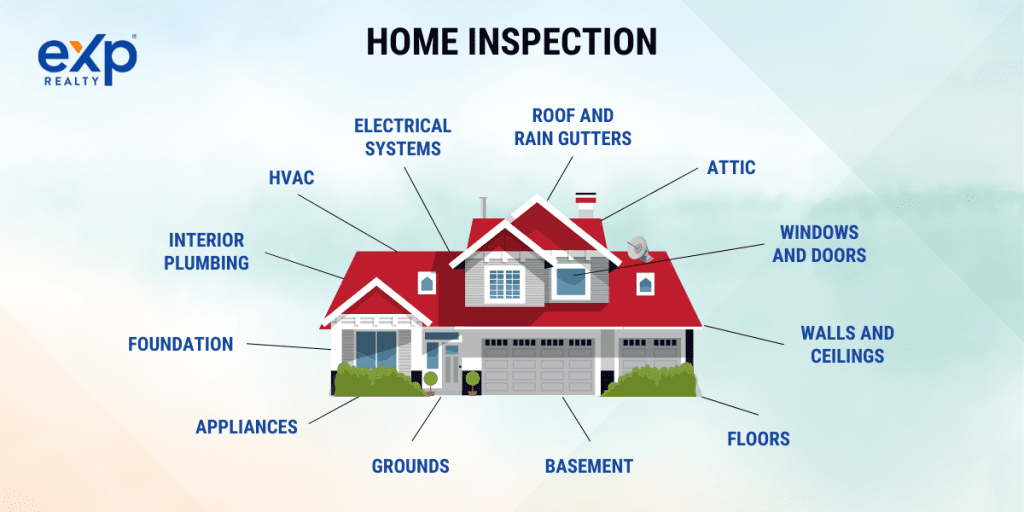

Before concluding the transaction, buyers must receive a thorough review of the property through an exhaustive home examination. Lenders also necessitate appraisals from licensed professionals who gauge how much value your new home holds compared to other properties in the vicinity to ascertain if you meet their financing criteria or need extra capital at closing time. Keywords: Home Inspection, Appraisal, Financing Criteria

Frequently Asked Questions: How to Make an Offer on a House

Buying a home is a tumultuous time. Below are some frequently asked questions about how to make an offer on a house.

What is the process of making an offer on a house?

The buyer may present their proposed terms, such as cost, date of completion, common contingencies, and other demands to the seller for evaluation. The seller then reviews the offer before either accepting it or countering it with different terms.

If both parties agree on all points of negotiation they can sign a purchase agreement that outlines all details related to the sale. This is followed by inspections, appraisals, and loan approval if necessary before finally closing escrow when ownership is transferred from one party to another.

How do you make an offer on a house in writing?

To make an offer on a house in writing, begin by detailing the property address and outlining your desired purchase price. Include any contingencies such as home inspection results or financing requirements. Sign the document with both parties’ names and dates to ensure it is legally binding.

Make sure all relevant documents are attached before sending the offer to the seller’s agent or attorney for review. Once accepted, you will be required to sign additional paperwork at closing that absolves the previous owners of any legal and ownership responsibility of the property. You’ll also provide your cash to close and down payment at closing.

Before putting in an offer on a home, ensure you:

- Research the housing market. Become familiar with the current real estate trends and prices in your desired area to ensure you get a fair deal.

- Get pre-approved for a mortgage. Secure financing before beginning your search so that you can make an offer quickly when you find the right property.

- Get an agent. Hire an expert in the local market to help you find, negotiate for and secure your desired home.

- Look at homes within your budget. Narrow down potential listings based on what fits within your financial limits and meets other criteria such as location or amenities desired.

What do I do once my offer is accepted?

Congratulations! Your offer was accepted. Your agent will guide you in the following steps and will work with you up until your closing date.

- Complete due diligence tasks. Have any necessary inspections done such as pest control or structural integrity tests; also obtain title insurance if needed.

- Sign a purchase agreement. Negotiate details related to contingencies like appraisal requirements, loan approval conditions, etc., then sign all relevant documents including promissory notes, deeds, mortgages, etc.

- Obtain a loan. Submit all necessary paperwork to secure a mortgage; ensure that the terms of your agreement are favorable and within budget.

- Close to the home. Attend closing meetings with the seller, real estate agent, and other parties involved in the transaction; sign final documents such as a deed or title transfer papers.

- Move into a new home. Make arrangements for movers if needed; coordinate utility setup; enjoy living in your new space.

Make sure you stay in touch with your agent and lawyer throughout the closing. At this stage, while you still have access to your agent, you should direct major questions about the process to your lawyer.

What is the rule of thumb for making an offer on a house?

When making an offer on a house, it is important to do your research and understand the market. Evaluate the housing market, compare residences in the vicinity, and contemplate any other aspects that could have an impact on pricing when making a bid for a home.

Additionally, be sure to take into account any additional costs associated with purchasing a home such as closing costs or repairs. Finally, factor in your budget and financial situation when deciding how much you are willing to pay for a property before submitting an offer. With this knowledge, you can assess what price would be suitable for both sides.

Remember to ask plenty of questions. Your agent is there to be your advocate, and don’t be afraid to tell them your concerns. Many agents also have a working knowledge of home construction and can spot potential problems before a home inspection, especially when it comes to wiring or materials that have been recalled due to safety concerns.

Final Thoughts

In conclusion, making an offer on a house in 5 simple steps can be a daunting task, but with the right guidance and preparation, it is possible.

Research the market, gain pre-approval for a loan, locate an expert realtor, and conclude the transaction – these are all essential elements in achieving your desired home. With this knowledge of how to make an offer on a house, you will have no trouble navigating through each step along the way.

Take the guesswork out of making an offer on a house contact us today.