You might have gotten some appreciation for that group project back in college or for that assignment at work, but when it comes to real estate, the word takes on an entirely different meaning. The housing market has been a rollercoaster over the past few years, with new listings fluctuating markedly in the purchase price.

Whether you intend to sell your current property, buy a new investment property, or are simply trying to make your money work for you, it’s crucial to understand the concept of home appreciation and what it means for you.

There has been the mention of appreciation rate, appreciation, and many other words that might have your thoughts in a knot, but if you’re trying to understand appreciation and how you can use it in your favor, you’ve come to the right place. Follow along to familiarize yourself with everything “appreciation.”

Understanding Home Appreciation

Math has never been at the top of the list of fun subjects for everyone. Still, fortunately, you don’t need a math degree to understand the calculations involved in home appreciation. Before getting ahead of ourselves, what is home appreciation in the first place?

Home appreciation refers to the increase in value of a home or an investment property (in which case, a spike in the monthly rent might indicate this). It is also essential to understand the counterpart of appreciation, depreciation, which refers to the fall in the value of a home or an investment property.

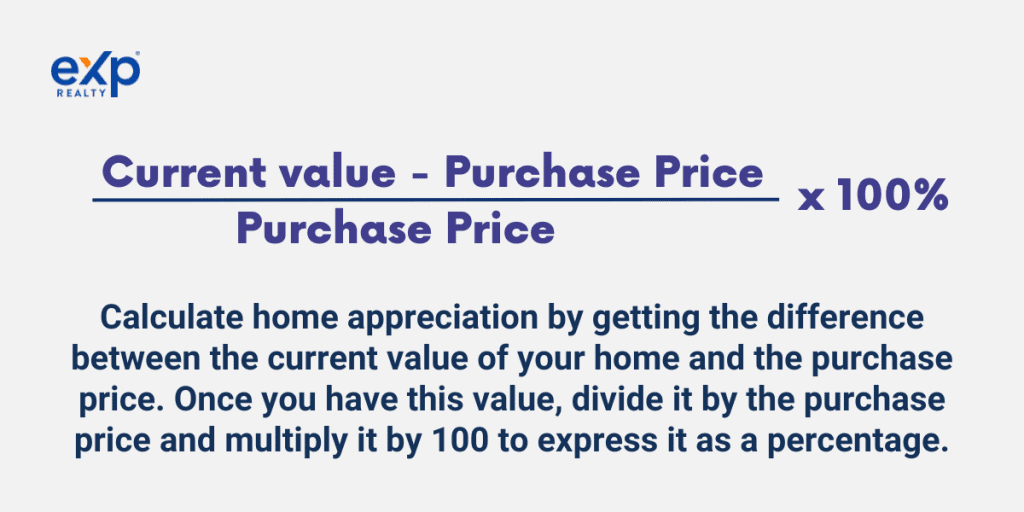

How to Calculate Home Appreciation

Appreciation is often expressed as a percentage, calculated by getting the difference between the current value of your home and the purchase price. Once you have this value, divide it by the purchase price and multiply it by 100 to express it as a percentage.

For example, suppose you bought your house at $200,000, currently valued at $250,000. In that case, the appreciation will be obtained by subtracting 200,000 from 250,000, which gives 50,000, then dividing this by 200,000 (which yields 0.25) and multiplying this by 100, giving an appreciation of 25%.

When calculating the appreciation rate, appreciation is related to a periodic change in time, which might be monthly or even annually. If the difference in time for the case sample above was one year, then the appreciation rate of the house is 25% per annum.

When Do Houses Depreciate?

Many people convince themselves that the status quo in the housing market is that houses are constantly appreciating. Despite this being accurate on most occasions, there are some special occasions when your investment might depreciate. Instances when your property can depreciate, include:

- In a fluctuating market where the prevailing market conditions negatively impact your house

- Secondary to obvious signs of physical wear and tear and deterioration

- Secondary to changes in the neighborhood that might negatively impact the desirability of homes in the community

- Changes in zoning, such as is the case when previously residential zones are transformed into commercial zones

Importance of Appreciation to Homeowners

If you’ve been paying attention, you might already see the advantages appreciation may have on your home and your financial situation. The following represent the key importance of appreciation to homeowners:

Build-Up of Equity and Wealth

Equity refers to the difference between the money you owe for the mortgage and the house’s actual value (basically, your cash claim on the house or property). With the increase in property value, aka appreciation, your equity in the house increases, essentially building your wealth.

Financial Gain through Selling or Refinancing

When you sell a house that has appreciated, you get to pocket the difference between the selling price and purchasing price as profit, thereby improving your financial situation. Additionally, you can get some quick cash through refinancing by getting a new mortgage on your house at the appreciated value.

For example, if you took out a mortgage to finance your house for $150,000, and the house has appreciated to $300,000, you might get refinancing and a new mortgage of 250,000, where you get $50,000 in equity and $100,000 in green ones.

Emotional Benefits

Just like you were happy with getting appreciation for your hand in the successful financial year at work, an appreciation in the value of your home can get your fix in dopamine from the happiness of knowing your house is making money for you in passive income.

Communal Benefits

Appreciation is an incentive for homeowners to take better care of their houses to ensure their value is constantly on the rise. The net effect of this on a community is that the curb appeal increases steadily, consequently raising the property value of houses within that neighborhood. This is also a goal of homeowner associations, whose ultimate purpose is to keep up property value so that community members can take advantage of home appreciation.

Factors that May Impact Home Appreciation and Home Value

You now have enough information on how appreciation may affect you as a homeowner, but what factors may impact appreciation, appreciation rate, and home value? Below is a list of the common factors that impact home appreciation:

Location and Neighborhood

The desirability of your neighborhood directly influences the appreciation rate of houses in your area. More desirable areas (such as those with an excellent school district, a nearby major shopping center, or a nearby park) tend to appreciate faster than those in less desirable areas.

Housing Market Trends

Fluctuating markets affect different neighborhoods differently. In some instances, they may result in the average price increase of houses or the converse. For example, there is a growing trend in migrating people away from urban areas. In that case, this may lead to an appreciation of suburban neighborhoods and a depreciation of urban areas.

Housing Market Conditions

Depending on whether it is a seller’s or buyer’s market, appreciation may deviate on either side of the scale. In a seller’s market (when the housing supply is less than the housing demand), houses tend to appreciate at a faster rate when compared to those in a buyer’s market.

Features of the Home

Do you have a pool in your home? Do you have modern amenities? If yes, these additional features may positively impact the appreciation rate of your property, resulting in higher prices. For this reason, updates and home renovations come in handy if you plan on selling.

Maintenance and Upkeep

As we mentioned earlier, a deteriorating home may burn a hole in your pockets by reducing the appreciation rate of your property or even leading to depreciation. Therefore, it is crucial to ensure you carry out routine maintenance on key features such as the roof, HVAC, and even the foundation.

Tips for Choosing a Home with Good Appreciation Potential

So, how do you make the right decision on an appreciating home? Some have it easier than others in this department, but you don’t have to leave it all to chance. Here are a few tips to help you choose a home with good appreciation potential:

Research the Local Real Estate Market

Carrying out your due diligence on a potential location for your home or investment property can yield valuable information. Research might help you pick out potential growth areas, predict market trends, or even find the right neighborhood (in this case, one that is good for living and provides favorable appreciation rates).

Look for Up-and-Coming Neighborhoods

Looking for that diamond in the rough will help you realize significant financial gain from appreciation and save you some money to lower the purchase price. However, consulting a real estate agent on the expected growth rate and city plans for your chosen area is important to make it less of a gamble.

Pay Attention to Location

The location has a critical impact on the average appreciation rate of a property. To make sure you put your best foot forward, you should prioritize the location of a home to meet your long-term needs.

Look for Homes with Unique Features

When looking for a new home to buy, you should look out for unique features that might increase the home’s appreciation percentage. With the current demand for a greener tomorrow, purchasing an energy-efficient home might do just that.

Consider the Age and Condition of the Home

Older homes lacking historic or architectural significance may become a sinkhole for your money in the long run as you spend more trying to meet repair and renovation costs.

Work With a Knowledgeable Real Estate Agent

A knowledgeable real estate agent is your safest bet toward making the best choice in a home with appreciation potential. This is because they have an unrivaled knowledge of the local housing market and prevailing marketing trends.

Home Appreciation and Homeowners

As mentioned earlier, appreciation might help you gain financially by increasing your equity in the house. Additionally, you may leverage appreciation to build wealth by getting a refinancing loan or getting, selling your house at a profit, or procuring another loan.

As a homeowner, it is your prerogative to ensure your house stands the best chance at appreciation by carrying out routine home improvements. Complete kitchen makeovers, updating your home to a “smart” status, or even improving to a hardwood floor can increase your satisfaction level and push the appreciation meter in the right direction.

The following is the importance of regular maintenance:

- Maintenance protects the value of your home from depreciation

- Helps in maintaining curb appeal

- It may help in improving energy efficiency

- May contribute to the extension of the lifespan of electrical appliances

Adding energy-efficient features will help you cut down on your monthly energy expenses while improving the appreciation rate of your home.

Key Takeaways

Home appreciation allows you to benefit from home and property appreciation, potentially helping you make significant financial gains. It would help if you always considered the appreciation potential of a home before making a purchase, regardless of your short-term or long-term goals. Contact a local eXp agent to find out more.

FAQs

Below are some frequently asked questions about home appreciation.

What does house appreciation mean?

House appreciation refers to the increase in the value of a house over time. Home appreciation rates are displayed as a percentage and showcase how much the value of a home has increased (or decreased) over a specific period of time.

What is a good appreciation rate for homes?

Depending on preference and other factors, individuals’ benchmark for a good appreciation value varies. However, an appreciation of 3-5% annually is considered healthy.

Do cheaper houses appreciate more?

Cheaper houses only sometimes tend to appreciate more; it depends on each individual scenario. Many factors affect the appreciation rate of a home, and certain cheap homes can present more problems than advantages. However, some cheap houses may present a large potential for appreciation.