When faced with debts and opportunities to improve the value of your home, many homeowners ask themselves are second mortgages a good idea? Taking out a second mortgage is like taking out a specific tool to do a specific job: increase your long-term profits or decrease your short-term losses. Whether you’re looking for a home in Atlanta Real Estate or in Portland, there’s a lot to consider before taking out a second mortgage. We’ll go over what kind of situations call for taking out a second mortgage, the pros and cons, and help you see for yourself if second mortgages are a good idea.

What Are Second Mortgages?

There are two types of “second” mortgages. There are mortgages that you can get when you purchase a home. Typically, the lender offers you 80% of the purchase price, and another lender (sometimes the same one) offers you 15% and you can purchase the home by putting 5% down. However, there is another type of 2nd and that’s made available by utilizing your equity.

There are two types of “second” mortgages. There are mortgages that you can get when you purchase a home. Typically, the lender offers you 80% of the purchase price, and another lender (sometimes the same one) offers you 15% and you can purchase the home by putting 5% down. However, there is another type of 2nd and that’s made available by utilizing your equity.

To understand second mortgages, we must first understand home equity. Home equity is the difference between how much your house is worth and how much money you owe for that house at any given time. If you buy a $500K house fully in cash you owe nothing to anyone, and so you have all the equity in the home. If you bought a $500K house with $50K down and the rest in the form of a loan, then you owe $450K. To find your home equity, take the value of the house, $500K, subtract the amount of your debt, $450K, and you’ll have $50K in equity.

Obviously, it’s a bit more complicated than that. Because of interest, your debt will grow slightly over time, and because of home appreciation, your equity will grow slowly over time. That appreciation, coupled with debt payments, should allow you to steadily increase your home equity.

If you’re still unsure about how you build equity, here’s a quick example. Let’s say a year goes by after you bought that $500K house and paid your loan debt down to $440K, but the housing market shot up and now your home has also appreciated in value from $500K to $600K. $600K – $440K = $140K. Now your equity is $140K. Had your home not appreciated at all, it would only be $60K.

The home-owning process is designed to help you build equity. Your equity simultaneously increases by you paying off your debt and your house appreciating in value. Your home’s value, debt, and equity are closely tied together and they are always changing, usually in your favor.

What is a Second Mortgage Really?

A second mortgage is a way to tap into that equity that you have accumulated, like drawing water out of a well. The more equity you have in your home, the more water there is in the well. The catch is you have to pay for drawing out of that value just like you would with your first mortgage. Another thing to remember: no second mortgage loan can ever exceed the equity you have built in your house, and with closing costs and risk assessment factors you’ll probably not be able to draw from the full amount of your equity.

Nevertheless, a second mortgage will grant you access to a (hopefully) vast reservoir of liquidity (cash) that you would not normally have access to without selling your home. To get a second mortgage, you must negotiate a new loan with a lender and choose what kind of loan is right for you.

Types Of Second Mortgages

There are two types of loans typically associated with the second mortgage process.

The Home Equity Loan

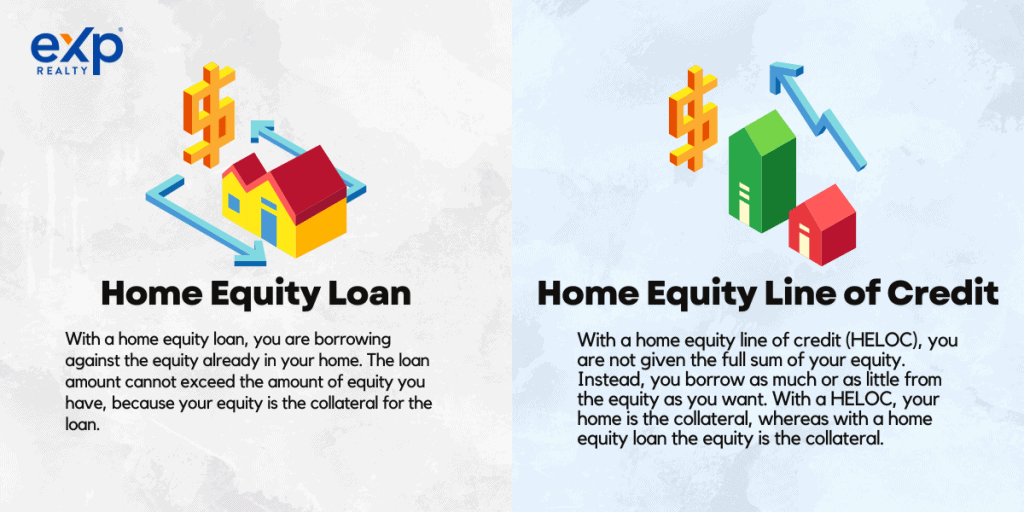

With a home equity loan, you are borrowing against the equity already in your home. The loan itself is a lump sum based on your equity, the value of your house, as well as your credit history. The loan amount cannot exceed the amount of equity you have, because your equity is the collateral for the loan.

Remember: Your first mortgage is against the value of your home. Your second mortgage is against the value of your equity in your home.

Finally, when you take out a home equity loan, you will most likely settle on a fixed-rate interest payment that will be higher than the rate of your first mortgage, but still lower than virtually any other equivalent line of credit that a person can get (i.e. credit cards). Home equity loan interest rates range between 5% and 12% and you can usually find loans between 5% and 8%. Compare this with credit card interest rates which are between 15% and 20% for significantly less money, and it’s clear which loan is the better option. When people are in a bind and need a lot of money fast, and they talk about getting a second mortgage, this is the type of loan they’re referring to.

The Home Equity Line of Credit

The home equity line of credit (HELOC) is similar to a home equity loan except you are not given the full sum of your equity. Instead, you borrow as much or as little from the equity as you want, with the understanding that you’ll pay off monthly balances and interest for the use of the credit. With a HELOC, your home is the collateral, whereas with a home equity loan the equity is the collateral.

Generally, this type of loan comes with a variable interest rate, meaning the rate changes according to the market, which can be good or bad for you depending on a whole world of factors. Interest rates for HELOCs tend to be around the same as for Home Equity Loans. Be wary of trying to ‘time’ the market and take advantage of low-interest rates, because lenders oftentimes charge prepayment fees, so that even if you pay off your debt early they’ll still be able to make a profit. Borrowers sometimes use HELOC to pay off higher-interest rate debts such as credit card debt, student loans, and car payments.

Are Second Mortgages a Good Idea? The Pros and Cons

The Pros of A Second Mortgage

Whether you’re taking out a home equity loan or a HELOC, you’re freeing up liquid wealth (i.e. cash) that you can use for whatever reason. Because you are paying interest on this loan, and because this loan is tied to your home, you should use this money wisely. Make lasting improvements to your home that will boost the house’s value and thus your home equity. These would be improvements along the lines of finishing basements, adding bathrooms and extra bedrooms, etc.

Whether you’re taking out a home equity loan or a HELOC, you’re freeing up liquid wealth (i.e. cash) that you can use for whatever reason. Because you are paying interest on this loan, and because this loan is tied to your home, you should use this money wisely. Make lasting improvements to your home that will boost the house’s value and thus your home equity. These would be improvements along the lines of finishing basements, adding bathrooms and extra bedrooms, etc.

Many homeowners take out second mortgages to help pay off higher interest debts i.e. credit card debt, medical bills, you name it. Though you certainly could use your HELOC or home equity loan like a trust fund or credit card, you’d be better off financially by using that equity to put yourself on steadier ground debt-wise or investing in assets that will net you long-term profits.

We mentioned earlier that second mortgages are a specific tool meant for specific purposes. You should work closely with a financial advisor when deciding whether or not to take a second mortgage out, not because second mortgages are a good idea or a bad idea, but to verify that you’ll actually make money (or lose less money) in the long run. If you’re trying to start your own business for example and you need money, there might be better loans out there for you than taking out a second mortgage.

The Cons of A Second Mortgage

If you’re not careful, taking out a second mortgage can make you house poor. Being house-poor means you cannot afford to maintain your home or pay off your bills each month, your savings get eaten away with each payment, and you run the risk of foreclosure. When you take out a second mortgage you are already paying off your first mortgage, and with a second you must make an additional payment each month.

If you’re not careful, taking out a second mortgage can make you house poor. Being house-poor means you cannot afford to maintain your home or pay off your bills each month, your savings get eaten away with each payment, and you run the risk of foreclosure. When you take out a second mortgage you are already paying off your first mortgage, and with a second you must make an additional payment each month.

Now, if you’re already doing alright and keeping your head above the water financially, and you use that second mortgage to quickly pay off your higher interest debts, then you’re helping yourself in the long run. If you’re using that second mortgage to renovate or add new rooms/marketable floor space to your house, you’re helping yourself in the long run.

If you’re not using your second mortgage to either increase your long-term profits or decrease your short-term losses, you run the risk of piling on even more debt in your life.

Are Second Mortgages A Good Idea?

It depends on how you use them. Everyone gets faced with unforeseen expenses in life, and when debt starts piling up it might seem like you have nowhere to turn. You could call a real estate agent and sell your house, but where will you live then? Where will your kids go to school? Will you be able to keep your job?

It’s not easy to pull up your roots. In a situation like that, where you must pay off your debts, take out the lowest interest loan you can. Nine times out of ten, that will be a second mortgage. If you’re using them to increase long-term profits, or decrease short-term losses, second mortgages are a good idea.