Congratulations on taking the first step toward homeownership! Being a first-time home buyer is an exciting yet daunting journey. It requires careful planning and preparation. With so many things to consider, from navigating the housing market to securing the right mortgage, it’s understandable to feel overwhelmed.

That’s why we’ve compiled 15 tips for first-time home buyers to help guide you through this exciting and life-changing experience. In this article, we’ll cover everything from the basics of house hunting to the advantages of first-time homebuyer programs. We’ll also discuss the importance of having a real estate agent by your side to help you navigate the process and find your dream house.

So if you’re ready to embark on the journey to homeownership, keep reading for our expert tips on how to make the most of your first-time home buying experience.

1. Determine Your Budget

For first-time home buyers, determining your budget is the critical first step in the home buying process. Knowing your financial boundaries can help you save time, avoid financial stress, and guide you toward your dream house.

Before house hunting, it’s essential to examine your finances closely. Check your credit report, debts, and income to determine how much you can afford to spend on a home. You can use a mortgage calculator and an affordability calculator to estimate how much you’d pay to own a house.

Setting a budget helps you narrow your options and focus on houses that fit your price range. It also helps you avoid the trap of overspending, which can lead to financial strain in the long run.

2. Choose the Right Location

Choosing the right location is a vital factor in the home buying process for first-time buyers. The location of your house determines your living environment and can significantly impact your daily life.

The right location gives you access to amenities such as nightlife, schools, hospitals, shopping centers, and parks, enabling you to enjoy a desirable living environment. The location also affects your mortgage rates and even the type of mortgage you can access.

Additionally, location is an essential consideration for the long-term value of your property. Buying a home in a desirable location can potentially increase the value of your property over time, making it a smart investment. You can ensure a comfortable and valuable home for years to come by taking the time to choose the most suitable location.

3. Work with a Knowledgeable Real Estate Agent

Working with a knowledgeable real estate agent is essential for first-time home buyers to make the homebuying process smoother and less stressful.

A real estate agent can provide expert guidance on the home-buying process, including first-time home buyer programs, mortgage options, and the costs of homeownership. They also typically have insider insights on homes on the market, having shown them several times.

Additionally, an agent can negotiate the purchase price, ensuring they get the best deal possible. Real estate agents also have access to exclusive listings that aren’t available to the public. This can expand your options and help you find your dream house.

With their experience and knowledge of the local market, real estate agents can guide you toward the best neighborhoods and houses that fit your budget and lifestyle.

4. Get a Home Inspection

As a first-time home buyer, you must get a home inspection. A home inspection provides you with a comprehensive evaluation of the property’s condition.

It can identify potential issues or necessary repairs that may not be visible during a regular walk-through, such as electrical or plumbing problems, roof damage, or pest infestations.

Identifying these issues early on helps you negotiate repairs or the price with the seller. This saves you money and ensures that you avoid safety issues and future costs.

A home inspection is also critical for a buyer’s peace of mind. It helps to know that you are making an informed decision about the condition of the property you are purchasing.

Home inspections are done by licensed and experienced professionals and are a valuable investment for any first-time buyer. They ensure the safety and long-term value of your dream house.

5. Research Homeowner’s Insurance

Every first-time home buyer should research homeowner’s insurance as they research their home options. Home insurance can provide coverage for property damage, theft, and liability. However, it’s essential to find the right coverage for your needs.

Researching homeowner’s insurance can help you compare policies, ensuring you get the best coverage for your property. By choosing the right policy as a new homeowner, you can protect yourself financially in case of damage or loss to your property.

Additionally, some mortgage programs may require private mortgage insurance, making it even more critical to conduct research and find a policy that fits your budget and needs. With the right home insurance coverage, first-time buyers can have peace of mind knowing that their investment is protected and their financial future is secure.

6. Review Closing Costs

As a first-time home buyer, you must review closing costs to understand the total expenses involved in the home-buying process. Closing costs are additional fees that buyers and sellers pay during the closing process. They can include appraisal fees, attorney fees, title insurance, and property taxes.

By reviewing these costs, you can avoid unexpected financial burdens and ensure you have enough money to cover all the expenses. Understanding the closing costs also provides a clear picture of the overall cost of homeownership, which is an important consideration when budgeting for a new home.

You can also work with your real estate professionals to negotiate some of the closing costs or find ways to reduce them. First-time buyers can ensure a smoother and less stressful homebuying experience by being proactive and informed about closing costs.

7. Consider the Resale Potential

Considering real estate potential is a smart strategy for first-time home buyers. It ensures you make a wise investment that may increase in value over time, leading to future financial gains.

When choosing a home, buyers should think beyond their current needs and consider the property’s long-term potential. Factors such as location, school district, and nearby amenities can affect the property’s value over time.

As a first-time home buyer, you can enjoy your dream house and hold a valuable asset you can resell by investing in a home with good potential. Real estate has historically been a sound investment, and by considering the potential of real estate, first-time buyers can start building their wealth and securing their financial future.

8. Don’t Rush into a Decision

Homeownership is a significant investment, and rushing into a decision can lead to buyer’s remorse and financial stress. First-time home buyers should ensure they find the right property for their needs and budget.

Carefully consider your options and weigh the pros and cons of different properties and neighborhoods. Also, you should research mortgage options and programs, ask the neighbors about life in the area, and consistently check your budget and priorities.

Rushing into a decision can cause you to overlook potential issues or hidden costs that may arise later on. Taking the time to make a well-informed decision can help you avoid these pitfalls and find a home you’ll love for years to come.

9. Be Prepared for Additional Costs

The home-buying process has many hidden costs. Be prepared for additional expenses to avoid unexpected financial burdens associated with homeownership.

Beyond the monthly mortgage payment, there are additional expenses that buyers need to consider, such as property taxes, homeowner’s insurance, maintenance, and repairs. As a first-time buyer, you must clearly understand these costs and budget accordingly. These affect your monthly payments and payment requirements, affecting your ability to pay your bills on time.

Additionally, beware that property taxes and insurance premiums can increase over time, and maintenance and repairs can add up quickly. It’s essential to factor in these costs when determining the budget. This helps you choose a home that is affordable not just in the short term but also in the long run.

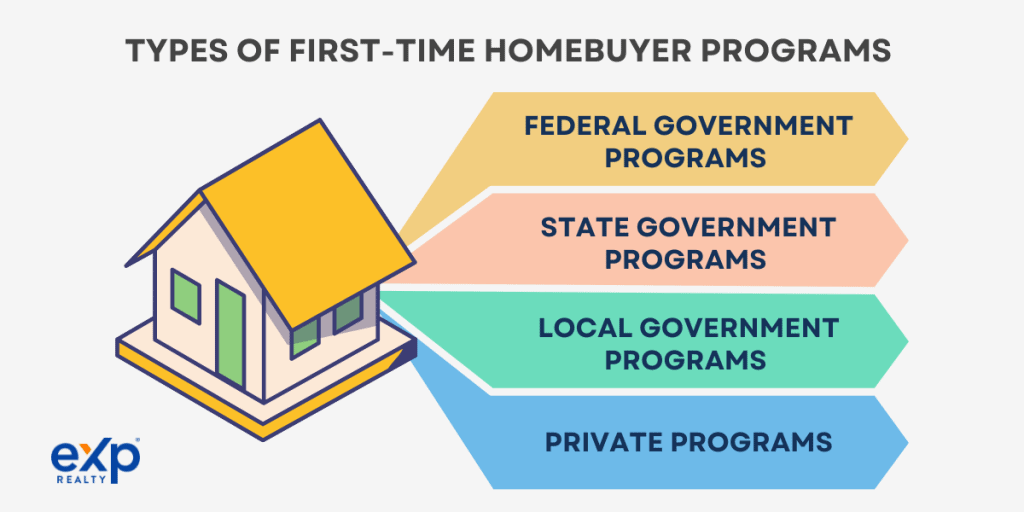

10. Take Advantage of First-Time Homebuyer Programs

All first-time home buyers should take advantage of first-time home buyer programs. These programs make homeownership more affordable and accessible through financial assistance, favorable loan terms, payment assistance programs, and other benefits.

Eligible first-time buyers can also benefit from mortgage options specifically designed for first-time buyers, such as FHA loans and VA loans. These programs can help first-time buyers get into the market with less money upfront and lower monthly payments.

Some programs also offer mortgage pre-approval if you meet specific requirements, friendlier mortgage terms, and adjustable-rate mortgages. You’ll also get information on what type of loan you qualify for, the loan process, and more.

By researching and taking advantage of these programs, you can save thousands of dollars, reduce financial stress, and make the journey to homeownership more manageable.

11. Understand the Homebuying Process

Thorough research on the home-buying process is essential for first-time home buyers. Knowing the steps involved helps you reduce stress, improve your negotiating power, and make informed decisions.

The journey to homeownership can be overwhelming and complicated, especially for those new to the process. Understanding the terminology, documentation, and legal requirements can give you an advantage when negotiating and finding the right property.

It can also help you avoid common mistakes and pitfalls that lead to unexpected expenses and delays. Do your research and seek guidance from real estate professionals to help you confidently navigate the home-buying process and potentially save thousands of dollars.

12. Be Flexible

As a first-time home buyer, you must keep an open mind. It’s perfectly acceptable to have a dream location or aesthetic. However, it can also limit your options in the current housing market. Having an open-minded approach can broaden your options and likely offer better deals.

Flexibility can also make negotiations with sellers and agents easier, potentially leading to better terms and deals. Additionally, it can help you avoid frustration and disappointment.

13. Don’t Let Emotions Control the Process

For first-time home buyers, purchasing a home can be an emotional process. The excitement of finding your dream house can cloud your judgment and lead to overspending, overlooking potential issues, and, ultimately, buyer’s remorse.

That’s why keeping your emotions in check during the homebuying process is crucial. Focus on the facts and figures, including the property price, location, and condition. This ensures you make rational decisions in line with your budget and needs.

Maintaining emotional control can also help alleviate the stress and anxiety associated with home buying. So, take your time, weigh your options, and stay objective to ensure you find the right property.

14. Research the Property’s History

As a first-time home buyer, conducting a thorough investigation is crucial. Conducting a thorough investigation into the property’s history can help you identify potential issues, such as liens, easements, or previous damage. This ensures you make an informed decision and avoids surprises down the line.

Researching the property’s history can also ensure that it meets your needs and expectations. For instance, you can discover past renovations, permits, or zoning restrictions that may affect your intended use of the property.

Through due diligence, you can make well-informed decisions and prevent potential headaches. Therefore, take the time to research the property’s history and consider hiring a professional to help you review any documents or records related to the property.

15. Consider Future Needs

Thinking beyond the present and considering your future needs as a first-time home buyer is essential. Finding a property that suits your current needs and budget is fantastic. However, you shouldn’t forget to consider your potential future needs and market conditions.

For example, are you planning to have kids or pets? Does your job require a lot of moving? Do you often get bored with routine and sameness? Answering these questions will help you determine what house is right for you.

Considering your future needs enables you to make informed decisions about your home purchase and ensures that your investment aligns with your long-term goals.

Key Takeaways

We’ve provided several essential tips to ensure a smooth and hassle-free home-buying process for a first-time homebuyer in a competitive market. These tips include choosing the right location, getting a home inspection, and researching home insurance. We’ve also mentioned why you should review closing costs, consider real estate potential, be prepared for additional costs, and take advantage of first-time home buyer programs.

By following these tips, first-time homebuyers can avoid unexpected financial burdens and find the right property that meets their needs and budget.

To help you on your home-buying journey, start your search for properties with eXp Realty and sign up for alerts of new property listings when they come on the market. You can also contact a local eXp agent for help or advice on the homebuying process.

FAQs: Tips for First Time Home Buyers

To help you better understand these important topics, we’ve compiled a list of related FAQs sourced from Google’s People Also Ask and forums and provided clear answers to help you make informed decisions when purchasing your first home.

What is the best way to buy a house for the first time?

The best approach for first-time homebuyers includes the following:

- Conducting thorough research

- Assessing finances

- Determining a budget

- Working with an experienced real estate agent

- Obtaining a home inspection

- Maintaining flexibility.

Additionally, taking advantage of first-time homebuyer programs can make homeownership more affordable and accessible.

What should a first-time buyer know?

First-time homebuyers should understand the intricacies of the homebuying process, including the terms used. They should research the property’s history and conduct a home inspection to get a good idea of the home’s value. They should also be prepared for additional costs and avoid rushing into a decision or letting emotions control the process.

What are five tips you recommend when purchasing a house?

The five essential tips to note when purchasing a home are:

- Work with a knowledgeable real estate agent

- Get a home inspection

- Research home insurance

- Review closing costs

- Consider real estate potential

How much do most first-time home buyers put down?

Most first-time homebuyers put down around 6% to 20% of the home’s purchase price as a down payment. However, the actual amount can vary depending on factors such as:

- Location

- Loan type

- Credit score

- Other financial circumstances.

It’s crucial to consult with a mortgage lender to determine the best down payment strategy for your situation.

What to avoid when buying a house?

When buying a house, first-time buyers should avoid overextending their finances, rushing into a decision, ignoring potential issues, skipping a home inspection, and not working with a real estate agent. These mistakes can lead to financial and emotional stress and result in a poor investment.

What are the four C’s when buying a home?

The four C’s when buying a home refer to the criteria lenders use to evaluate a borrower’s creditworthiness. These are credit score, capacity to repay, collateral, and capital. These factors help determine the loan terms, including:

- Interest rate

- Down payment

- Loan amount.

First-time home buyers should understand these factors to help them secure the best possible loan terms.

What are the three most important things when buying a house?

The three most important things when buying a house are location, condition, and price. The location should be in a desirable area, the condition of the house should be inspected thoroughly, and the price should be within the buyer’s budget.