Are you thinking about buying a single-family house? This guide will teach you all the advantages and disadvantages of investing in a single-family home before you jump headfirst into the housing market.

At the end of this post, you’ll learn to weigh if this is the right house and if it’s worth your money.

What is a single-family home?

The U.S. Census Bureau defines a single-family house or single-family detached home as a residence separated from the adjacent unit by a wall extending from ground to roof. It’s constructed on a separate parcel of land, which makes it a detached property or stand-alone house.

A typical single-family home is a separate, single dwelling unit that has direct access to the streets, is owned by a single person, and is designed for one family. To own a detached single-family house, you must buy the house and the land, unlike in condos and apartments, where you own the unit but not the entire building and land.

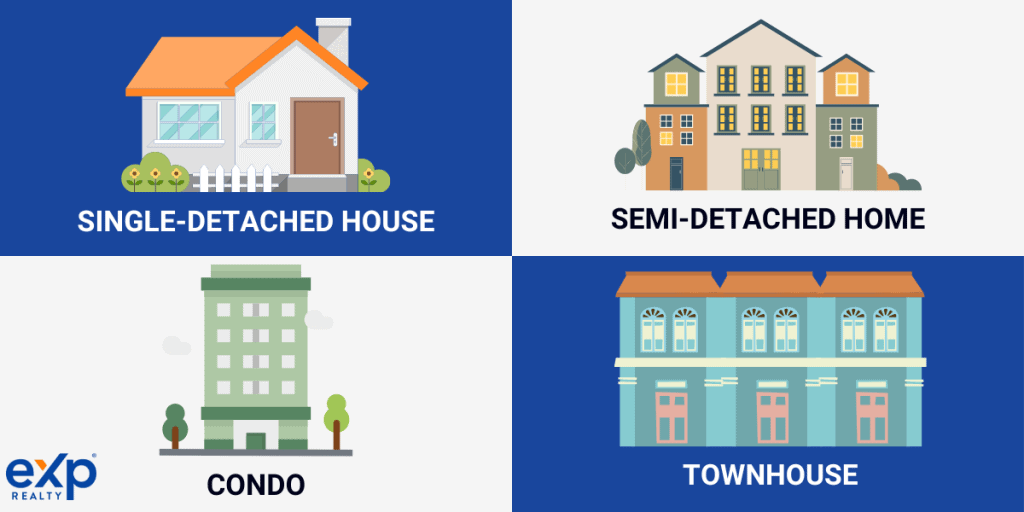

Differences Between Single-family Houses and Other Types of Homes

If you’re looking for a new home to call your own, it is important to understand the housing types because a wide range of options is available depending on your lifestyle and needs. Single family homes are great for those who want some privacy and independence. The most common type of this home is a detached house, which offers the highest amount of privacy and no shared walls or adjacent buildings.

Condos and apartment buildings, however, offer unique benefits such as higher affordability than single-family homes. Aside from being a more affordable housing, living in individual units provide access to community amenities like swimming pools, gyms, and lobbies but owners only own their units. Condos also have lower property taxes and are excellent investment properties.

Even though they are not freestanding structures, townhomes usually combine the best of both worlds – they’re typically more affordable than detached houses while still providing that same independence and security. Townhome owners commonly own their units and the land, including the yard.

There are also multi-family homes constructed as one unified dwelling, but broken into separate living spaces that can accommodate multiple families. Multi-family homes provide the unique ability to be part of a larger space while still enjoying privacy and autonomy.

When it comes to multi-family homes, the options are limitless. Multi-family dwellings come in a vast array of styles, with options ranging from duplexes – which hold two homes within one structure – to fourplex buildings comprising up to four separate apartments.

At what point does a single-family home become a multi-family home?

A multifamily home is a residence with multiple units. Each unit has a separate entrance, bathroom, kitchen, and other utilities, but it’s built on the same land. The units in a multifamily building connect through the side of one another or are stacked on top.

The common area makes this type different from the single-family home. The residents in multifamily properties share the same stairs, elevators, and garage. Multifamily homes also use the same amenities, such as swimming pools, playgrounds, and fitness centers.

A multifamily property or multifamily building has individual utility meters and outlets for each unit, but they all use the same systems and facilities, such as water tanks and furnaces.

Characteristics of a single-family home

Listed below are the specific features that differentiate it from other houses.

- Category: Single-family homes are residential real estate. It’s available as a short-term rental or an accessory dwelling unit (ADU).

- Outdoor space: The spacious exterior allows you to enjoy a backyard and a garden.

- Privacy: It eliminates neighbor nuisance because it’s impossible for you to overhear discussions from the other house. You also don’t have to worry about managing any shared spaces like you would if living in an apartment building.

Pros and cons of owning a single-family home

Here are the advantages and disadvantages you must consider when choosing a single-family home.

Pros of owning a single-family home

The pros come in three categories including features and amenities, fees, and investment.

Features and amenities

- Property modification: Single-family homeowners have a lot more leeway to change the interior and exterior of the house. It’s also a good option if you’re looking to purchase a fixer-upper home.

- Access to amenities: You can use the amenities whenever you like. You can add appliances as often as you desire, and you have the freedom to install them. You have your own backyard as well as your own driveway so you can easily host barbecue parties and get togethers with friends or family.

- Extra storage: If you own tools that need a bigger space, the attic or garage serves as an additional storage space.

- Privacy and freedom: In single-detached homes or separate houses, you control the temperature, volume, who comes in and out, or whether you want pets. That doesn’t happen in multi – family homes.

- Space: As a separate house, a single-family home ultimately provides plenty of space where you can relax during stressful days without having to worry about too many rules and regulations.

Fees

- Maintenance fee: You can pay for the maintenance and insurance costs at a lesser price. If a tenant lives on your property, the repairs and maintenance costs are lower because long-term tenants take better care of the property.

- Insurance: Homeowners’ insurance can cover single-family homes and does not need a dwelling policy.

Investment

- Resale value: Single-family homes are considered good real estate investments because they consistently increase in value when sold. It’s because a lot of buyers favor owning their own house.

- Tenant turnover: Compared to multi-family houses, single-family home tenants stay longer. Most owners don’t often move to a new property, since their children attend school.

- Cash flow: You draw in better-quality tenants who pay their rent on time. They also take care of any agreed-upon expenses and maintain your home better.

- A property manager is not necessary: You can manage your house (as a rental property) without the help of a property manager because it’s easy to deal with a single tenant.

- Capital gains exclusion: When it’s time to sell your single-family house, you may qualify for capital gains exclusion under certain circumstances as outlined in IRS Publication 523 “Selling Your Home.”

If you meet the specific criteria, such as having lived in your residence at least two out of five years before the sale, it excludes up to $250k ($500k if married) in profit from taxation.

It reduces how much money you owe after selling your home. This policy encourages people to buy houses more, which helps stimulate economic growth across communities nationwide.

Cons of owning a single-family home

- Higher cost of ownership: It costs more upfront and might cost more over time because of the home maintenance. But if you rent a condo, you only have to pay a minimal fee.

- Lower tenant: A multi-family property enables you to host more renters, which means more money. If you want to raise your income, investing in a single-family home is not a good option. Also, it’s hard to increase the rental fee because the tenant remains longer.

- Additional responsibility: One drawback of owning a home is property care. You maintain your lawn and handle any repairs. If you don’t want to do household chores, you must save a little extra to hire someone to do the job for you.

As you notice, the cost of acquiring the property is not included in the pros and cons, as the affordability of a single-family home depends on your purpose of buying.

If you’re buying it as your personal space, it can be higher than renting a single unit in a condo. The high upfront fee of a single-family home comes from fees for real estate agents, lawyers, and title agencies.

A single-family home is less expensive to purchase for investment because buying a multi-family home as an investment is higher upfront.

You can buy the single type with a down payment of 15% to 20% of the entire cost. Take note the price includes the land.

Take away on investing in the property

Invest in single-family homes if you prefer appreciation versus cash flow. It’s the type of investment you need to make if you want more reliable tenants over the long run and a liquid asset.

Owning a single-family home can be a smart investment since it offers tax benefits like capital gains exclusion, mortgage interest deductions, and property tax deductions.

FAQs: What is a Single Family Home?

Here are some frequently asked questions (FAQs) about single-family home ownership that we’ll address one at a time.

What is meant by a single-family home?

It’s a single property, usually detached, for one household or family. When you become a single-family homeowner you’re also buying the land.

Why is it called a single-family home?

The term refers to a particular housing typology designed to accommodate just one family or household. It also refers to a land-use policy.

What are the three key attributes of a single-family residential property?

The key attributes of a single-family residential property are:

- The structure

- The number of households it can cater to

- The privacy it provides

What are the advantages and disadvantages of a single-family home?

Single-family homes have large yards, which is a great advantage for growing families with kids who like playing outside. It provides a sense of peace and intimacy that is hard to experience when you hear your neighbor next door.

You can customize your home without having to worry about co-ownership. You can also renovate and expand your home. High house taxes, maintenance fees, and purchase prices are disadvantages.

What is a townhouse vs. a single-family home?

A townhouse connects with an adjacent house by at least one shared wall. It has a high structural quality, and it’s built in rows. The unit owners own the driveway and the lawn. A single-family home is freestanding.

What is the difference between single-family and multi-family dwellings?

A multi-family dwelling has more than one housing unit. Examples of this type include a duplex, a townhouse, and an apartment complex. A single-family house is a solo unit not shared with another household.

What is the average size of a single-family home in the US?

Compared to other types of residences, single-family homes are bigger. You can buy a house with about 2,500 square feet. ft., which is larger than the typical average of multi-unit dwellings at 1,076 sq. ft.

Is buying a single-family home a good investment?

With the pros and cons mentioned, a single-family home is a good investment for entry-level investors. It’s more manageable than owning multiple dwellings. You don’t need to hire a property manager if you want to manage it on your own. It’s also less risky to own this type of property.

What is the difference between an attached and detached single-family home?

An attached housing connects by common walls. It has shared property lines on different land parcels. The outside wall of this house touches the neighboring house. A detached family home is a house on a single plot of land with no other home attached to it.

Why do single-family homes appreciate faster?

A single-family detached home appreciates faster because of the land it’s situated. Remember that when you buy this type of dwelling unit, you’re also buying the land. The land always appreciates as we all know.

Are you ready to buy a house? Check out single-family homes for sale on eXprealty! And if you need additional help searching for single-detached houses in your area you can also contact a real estate agent to give you a hand in your house-hunting process. Good luck!