A home warranty is a great way to protect your home from costly repairs and replacements. It covers major mechanical home systems, such as electrical, plumbing, heating, air conditioning, appliances, and home components, such as windows, doors, and roofs. Many are not fully aware of precisely what a home warranty is or the limitations they have.

Home warranty plans vary in structure. Some plans are simple, while others cover a wider set of appliances or major home systems. Understanding how a home warranty works can help you make informed decisions about protecting your home and budget.

What is a Home Warranty?

A home warranty gives homeowners peace of mind by protecting against unexpected repairs and replacement costs for specific appliances and major home systems. Appliances are basic machines installed in homes for a home’s daily use, while systems are a set of appliances and components that work together, like the HVAC or plumbing systems.

Understanding a home can help homeowners make informed decisions about protecting their investment and budgeting for potential repairs. Home warranties cover major home appliances, electrical systems, plumbing systems, and HVAC systems but do not cover structural features such as windows, doors, and floors. You should carefully review the terms and conditions of a home warranty contract to understand what is covered and any limitations or exclusions that may apply.

What are the Coverage and Benefits of a Home Warranty?

A home warranty is a service contract that covers the repair, replacement, or servicing of major home appliances and major systems. It provides financial protection against unexpected breakdowns and repairs that can be costly. Home warranties typically last one year, but some companies offer multi-year coverage plans ranging from 2-6 years.

Home warranty coverage can include essential appliances such as refrigerators, ovens, dishwashers, and washing machines. Some companies also cover additional items like ceiling fans, sump pumps, and well pumps. The coverage may vary depending on your chosen plan, but most companies offer comprehensive coverage plans for all appliances and major systems, comprehensive and appliance-only plans.

While a home warranty can help reduce repairing or replacing appliances costs, you should be aware that deductibles and out-of-pocket expenses may apply. Home warranties have deductibles and fixed expenses that policyholders pay when submitting a claim to repair, service, or replace an appliance or home system. The deductible is usually lower than homeowners’ insurance deductibles, reducing plan holders’ out-of-pocket costs.

Basic & Comprehensive Coverage Options

Home warranty plans can be basic or comprehensive, it all depends on the coverage details. Basic plans cover basic items such as your refrigerator, stove, and HVAC. Comprehensive plans have a varied range of coverage options.

Additional items covered with comprehensive plans are: A basic home warranty plan typically covers essential home major systems and appliances, such as plumbing, electrical systems, heating, and built-in appliances like dishwashers and ovens.

For example, the Choice Home Basic Plan covers 14 items, including plumbing stoppages, ceiling fans, garbage disposals, cooktop exhaust fans, built-in microwaves, ductwork, garage door openers, toilets, and water heaters.

While this plan offers good coverage for many homeowners, it does not include coverage options for air conditioning systems, which can be crucial for residents living in warmer climates like Georgia.

On the other hand, a comprehensive home warranty plan provides a more extensive coverage option by including other systems and appliances that may not be covered under a basic plan. The same Choice Home Warranty offers a comprehensive protection plan that covers all the items in the Basic Plan plus:

- Air conditioning systems

- Refrigerators

- Clothes washers

- Clothes dryers

This type of protection plan is particularly beneficial for homeowners who want to ensure that their air conditioning units are covered, as repairs for these systems can be quite costly.

Add-On Coverage

Home warranty plans can offer supplementary coverage for items not included in basic or comprehensive protection plans, such as in-ground pool and spa setups, roof leak coverage for single-family homes, central vacuum systems, septic systems minus components, septic tank pumping, sprinkler systems, standalone ice-makers, second refrigerators, sump pumps, trash compactors, and well pumps.

Appliances

The types of appliances covered under a home warranty are typically those that are considered essential for daily living. Home warranty plans commonly include major appliances such as refrigerators, ovens, dishwashers, and built-in microwaves.

However, it is important to note that not all appliances may be covered; significantly smaller, free-standing appliances like countertop appliances, juicers, blenders, or water filtration systems. Basic plans usually cover only basic appliances, while comprehensive plans cover routine maintenance and repairs on appliances and systems.

How the Claims Process Works

Filing a claim for appliance repair or replacement under a home warranty is straightforward. First, verify and understand your coverage by reviewing your home warranty contract. This will help you determine if the appliance is covered and avoid misunderstandings during the claims process.

Survey the appliance that is in disrepair and ensure mitigate any supplemental damage such as water spilling onto the floor or electrical exposure. Your coverage may not cover additional damage caused by an appliance in disrepair. It is a good idea to document notable damage to provide proof of the appliance breakdown.

Next, request a service visit from a contractor affiliated with your home warranty company by contacting your home warranty provider. Most companies have a network of trusted contractors they work with, so it is essential to use their services to ensure your repair costs are covered. Once the service visit has been scheduled, you must pay the service fee and any uncovered repair expenses as outlined in your policy.

Be sure to recognize the difference between a home warranty repair and a repair that your homeowner’s insurance would cover. If you are unclear, your home warranty provider may help you assess if your home warranty covers the appliance issue. If you still have questions, contact your homeowner’s coverage provider to determine if your issue is a homeowner’s claim.

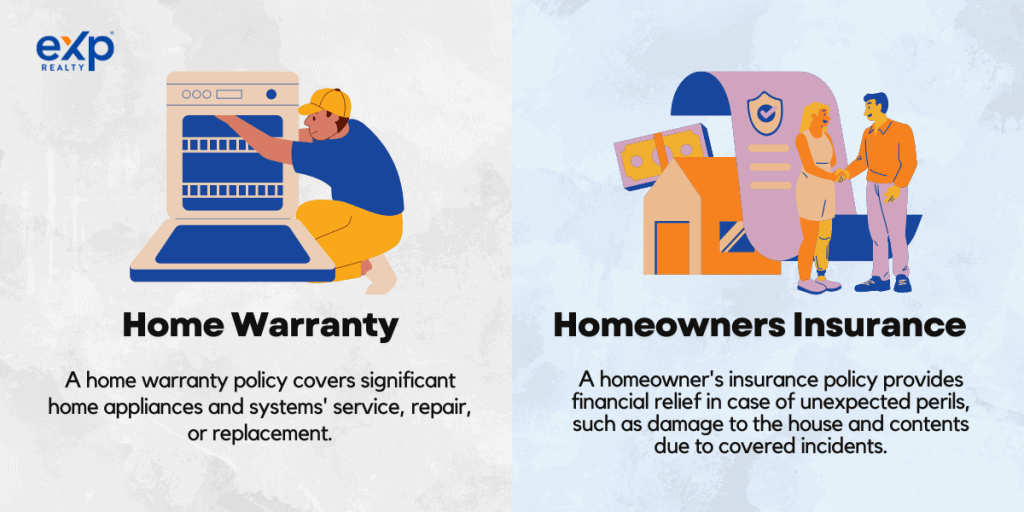

Home Warranty vs. Homeowners Insurance

Home warranty and homeowner’s insurance are good policies for your home, but they are not the same. A home warranty policy covers significant home appliances and systems’ service, repair, or replacement. In contrast, a homeowner’s insurance policy provides financial relief in case of unexpected perils, such as damage to the house and contents due to covered incidents. Homeowners may cover appliance repair if the repair is the result of unexpected peril.

Contract terms between both are different too. A home warranty plan covers only what is listed in the contract; some plans are more robust than others. Homeowners must verify their coverage before requesting a service visit to file a warranty claim. They also need to pay the service fee and uncovered repair expenses. On the other hand, homeowner’s insurance policies typically have minimum coverage requirements set by lenders as a condition of issuing the mortgage.

The claim process for a home warranty involves contacting the warranty provided with the product’s serial number and a dated sales receipt. In contrast, the claim process for homeowner’s insurance consists in filing a claim for unexpected events that lead to damage, such as fire, weather, or vandalism.

Overall, both policies benefit homeowners but cover different aspects of home protection. Home warranties cover expected events, such as the appliances and systems that have worn down with age, while homeowner’s insurance covers unexpected events that cause damage. You should read the fine print of each policy to understand what’s covered and what isn’t.

Homeowners should also be aware of the typical exclusions of home warranties, such as structural issues, commercially classified kitchen appliances and systems, improper installation, including mismatching system components, and maintenance issues or neglect.

Likewise, homeowner insurance policies include similar exclusions, but these exclusions are based on the risk of unexpected events taking place, such as living near the coast where a home is likely to be damaged by flooding waters or a hurricane.

Home Warranty Costs

The cost of a home warranty typically ranges from $432 to $816 per year, with a national average cost of $700. Several factors determine the cost of a home warranty policy, including the premium, the service fee, and any add-ons the homeowner chooses.

A service fee is a fee you pay for a covered repair. This differs from your plan fee, which is paid annually or in monthly installments. Service fees vary based on plan level. Some providers offer the same service fee for all plan tiers, which gives them a competitive advantage. However, it is not uncommon to see service fees range from $60 to $175 or more. Typically, the higher the service fee, the lower your premium.

Factors that Affect Warranty Costs

The type of coverage purchased can significantly influence the cost of a home warranty. The more comprehensive your policy, the higher your annual premium will be. Additionally, the size and age of your home can affect the home warranty cost. Larger homes and older homes are generally more expensive to insure due to the increased likelihood of repairs or replacements for appliances being needed.

The location of your home can also impact the cost of a home warranty. Generally, the cost of a home warranty increases as you move further away from large metropolitan areas. This is because there are more service providers in larger cities, and they can offer more competitive rates.

There is less competition among providers in rural areas, so companies can charge more without losing customers. Homes in areas with high crime rates or prone to natural disasters (or severe weather conditions) may also have higher warranty costs due to the increased risk of damages.

Pros of Having a Home Warranty

A home warranty can provide numerous benefits to homeowners. One of the most significant advantages is peace of mind, knowing that unexpected and costly repairs of major appliances and mechanical systems in the home are covered. This can be especially beneficial for those who don’t have an emergency fund or want to reserve it for other expenses.

Additionally, a home warranty can save homeowners money by eliminating the need to find a contractor when something breaks down. The average cost to repair a refrigerator is $250. This is nearly fifty percent of the average annual cost of a home warranty.

Home warranty providers make it easier to get professional repairs through a network of contractors. You would only need to make one call to get their appliances serviced. Other pros of having a home warranty include:

- Protecting your investment

- Keeping your appliances in working order

- Minimizing stress levels

You should research to find a trustworthy home warranty company that uses reliable contractors and will cover good repairs when necessary; nonetheless, one should be aware that home warranties have certain restrictions and exclusions, and homeowners could have limited or no input on the replacement component model or brand.

Cons of Having a Home Warranty

One of the main limitations of a home warranty is that it only covers what is specifically outlined in the agreement with the provider. This means that anything not included in the contract will not be covered.

Additionally, home warranties often have exclusions, meaning that certain items or appliances that were already broken or initially installed improperly won’t qualify for coverage. Structural, plumbing, and electrical adjustments needed to install new items may also not be covered.

Another con of home warranties is the service fees typically charged for each repair service. While some providers offer a selection of service fee levels, choosing a lower service fee may lead to higher monthly premium costs. Conversely, selecting a higher service fee level means paying more for each repair claim with the possible benefit of a lower plan premium cost.

Delays in repairs can also be a drawback of home warranties. Home warranty providers service your appliances on their schedule with their repair providers, meaning you may not have as much input into the repair process as you would like. Additionally, you could be subjected to fees if a claim is denied, leaving you responsible for additional repair costs.

It’s important to review your home warranty contract to understand what is carefully and isn’t covered, as well as any limitations or exclusions. While home warranties can provide peace of mind and expert service, they may not be the best fit for everyone.

Choosing the Right Home Warranty Provider

When choosing a home warranty provider, you should carefully review the coverage and benefits offered by each provider to ensure that they meet your needs. This includes understanding any limits or exclusions that may apply to specific systems or appliances. Additionally, you should consider the costs associated with each provider, including premiums and deductibles.

Another essential factor to consider is the reputation of the provider. Look for reviews and ratings from other customers to understand their customer service and satisfaction level. You should also review the contract terms carefully to ensure that you know all of the details, including any limitations on coverage or requirements for service.

Key Takeaways

Ultimately, choosing the right home warranty provider requires careful research and consideration. By reviewing your options and understanding each provider’s terms and conditions, you can make an informed decision that provides you with the coverage and peace of mind you need. Remember to consider the appliances and systems in your home and ensure the policy you chose will provide adequate coverage.

When considering a home warranty, knowing what’s included in the plan and what’s not is important. Most plans will cover repairs and replacements due to normal wear and tear.

Some plans may have additional coverage for certain items like pools or septic tanks. Ensure to select the add-ons your home needs to cover appliances and systems that are not a part of the home warranty basic or comprehensive plans.

It’s also important to understand the plan’s limitations and fees, such as the cost of service calls, deductibles, and exclusions. Although fees can fluctuate based on your home size, where you live, and your overall coverage choices, the cost is still lesser than the cost of an unexpected repair or replacement.

Remember, homeowner insurance is different from a home warranty. Do not assume that your homeowner’s insurance covers repairs on appliances. Your homeowner’s insurance only covers appliances when they are damaged by a perilous event, such as a storm or damage to the home that leads to damage to an appliance.

FAQs: What is a Home Warranty

You may have additional questions that require clarity. Check these frequently asked questions to learn more about a home warranty.

What is the Purpose of a Home Warranty?

A home warranty provides homeowners financial protection and peace of mind by covering the cost of repairs, service, or replacement of major home systems and appliances due to normal wear and tear. It acts as a buffer against expensive breakdowns and can extend the protection plans of manufacturers’ warranties after they expire.

Buying an older home with limited knowledge of its inner workings can be risky, but a home warranty can be a great way to give yourself peace of mind. It is perfect for those who have used all their savings to purchase a home and are concerned about unexpected breakdowns.

However, it is important to carefully read the terms and conditions of the contract and determine if the warranty is likely to pay off based on the age, condition, and quality of appliances and systems in the home.

Do Home Warranties Actually Cover Anything?

Home warranties cover anything included in the policy. A home warranty is a service contract that pays for repairing or replacing covered items such as major kitchen appliances and plumbing, heating, air conditioning, and electrical systems. However, it’s important to note that a warranty doesn’t cover the structure of a home, like windows and doors.

Additionally, there are limitations to what is covered in the agreement with the provider, and exclusions apply. Home warranty providers service your appliances on schedule with their repair providers, giving you less input.

You should read the terms and conditions carefully to determine if you will benefit from the plan based on the age, condition, and quality of appliances and systems in your home. Consider add-ons where applicable.

Is a Home Warranty the Same as Home Insurance?

No, home warranties and home insurance are not the same. A home warranty covers normal wear and tear on specific home appliances and major systems. That includes electrical systems, air conditioning systems, heating, and plumbing systems.

At the same time, homeowners insurance takes care of damage to the house and contents caused by insured perils. Though similar in some ways, the two offer different types of protection. You’ll pay a fee to the provider to secure both your home and its contents.

Pairing a Home Warranty with a traditional homeowners insurance policy is recommended to secure the most comprehensive coverage for your home.

What is the Best Way to Use a Home Warranty?

The best way to use a home warranty is to contact the warranty company first for repairs and ask to hire your service provider if possible. Know that you can take a cash payout and manage the repair process directly with a contractor if your policy allows.

It’s important to understand what’s covered and what’s not before facing a necessary repair and contacting the warranty company. Additionally, it’s crucial to examine the different levels of coverage for items that a potential plan offers and understand exactly what is covered for each home system and/or appliance.

Are Home Warranties Expensive?

Home warranties are affordable compared to the cost of a repair. With the average cost ranging from $432 to $816 per year, your average monthly payment could be $36 to $68, and you can also expect to pay a service fee of around $60 to $175 each time a technician comes to your home.

Are Home Warranties Worth it on Older Homes?

Home warranties are worth it for older homes. As systems and appliances age, they become more prone to breakdowns, leading to unexpected expenses and stressful situations. A home warranty from a reputable provider can provide peace of mind and protection against these issues. However, it’s important to remember that coverage has limitations and exclusions, so reviewing the contract carefully before signing up is essential.

Additionally, coverage limits may apply to certain outdated appliances or systems or are no longer compliant with codes. The cost of a home warranty for an older home can vary depending on factors such as the size and location of the house.

Is it Common to Ask for a Home Warranty?

It is common for buyers to ask sellers to pay for the first year of a home warranty. This can benefit both parties, as buyers may be less concerned about the condition of major appliances and systems, and sellers may have a better chance of closing a deal.

Offering a home warranty can make a home more desirable to prospective buyers, giving them more confidence and peace of mind with their purchase. Home warranties are transferable.

How Long Does Home Warranty Insurance Last?

Home warranty insurance typically lasts for one year. Most home warranty companies offer a yearly service agreement that can be renewed yearly. The waiting time period for coverage to apply is usually 30 days, which helps ensure that there are no pre-existing problems when purchasing coverage for items. Home warranty plans can be paid annually or monthly, depending on the homeowner’s preference.

How Do I Know if My Home Came with a Warranty?

If you have purchased a home and are unsure if it came with a warranty, there are several ways to find out. First, contact the title company or realtor who closed the home sale, as they should have records indicating whether or not a home warranty was included in the sale.

What Should I Look for When Choosing a Home Warranty?

When looking for a home warranty company, it is important to understand the coverage, limits and exclusions, prices, and whether the technicians used by the company are licensed and insured.

It is also important to review the service agreements offered by the company to determine which home systems and appliances they will cover and under which conditions. Ultimately, finding the right home warranty company for your needs requires careful research and consideration of your specific coverage for items needs and budget.

Is a Home Warranty Worth it for a Seller?

A home warranty can be worth it for a seller, as it provides coverage if a system or appliance breaks before closing the house. Additionally, offering a home warranty can make a home more desirable to prospective buyers, giving them more confidence and peace of mind with their purchase. A seller’s warranty covers the home’s systems and appliances while on the market, and once the home is sold, the warranty can be transferred to the buyer.

What’s not Typically Covered in a Home Warranty?

Home warranty plans do have limitations, and some of those limitations are:

- Cosmetic damage to the home

- Pests damage

- Neglect of misuse of the major systems and appliances

- Adjustments or adaptations needed when replacing existing equipment or when installing new equipment

- Existing issues, such as a malfunctioning system or device damaged before the start of home warranty coverage for items

- Items safeguarded by a manufacturer’s warranty

Final Thoughts

If you don’t have a home warranty for your home, you should consider its benefits. Home warranties can benefit homeowners who are settled into their homes and those who are preparing to sell their homes.

Realtors are advocates of home warranties as a tool to protect your existing or construction home and increase its value. Contact a local eXp real estate agent to see how a home warranty with comprehensive coverage could benefit you as part of your real estate transaction.