Buying a home is a dream come true for most individuals. It’s a beautiful milestone and an excellent investment. However, with the rising cost of real estate, finding a good one for a fair amount can be challenging.

Fortunately, there is one option often overlooked – short-sale homes. Although not as popular as traditional purchases, they offer an excellent opportunity for first-time buyers looking for a good deal. You can save money and get your desirable home at a sale price less than market value.

But it’s not as easy as it may sound. The sale experience can be time-consuming and complex. In today’s post, we’ll guide you through buying a short-sale home and share tips to ensure you win the offer.

What Is a Short Sale?

A short sale occurs when a financially distressed homeowner involuntarily sells their home for less than their mortgage balance.

The lender recognizes the losses and accepts a discounted payoff amount. Importantly, they avoid the negative ramification of foreclosure. On the other hand, the seller is relieved of their debt burden and can start afresh. Unfortunately, they walk away with nothing.

In this type of transaction, both parties must be willing to compromise. However, it’s a lengthy and complicated process compared to a traditional sales application. If you’re a potential buyer, you may want to tread carefully for this type of sale.

Make sure you understand what you’re getting into before making an offer. Do your homework and ask questions if necessary. That way, you’ll have a better chance of making a successful purchase. That said, there are various reasons for a short sale, including the following.

Financial Hardship

Life can sometimes throw us a curveball. Unforeseen expenses, job loss, illness, or divorce can all lead to financial hardship. These circumstances can make it impossible for a homeowner to keep up with mortgage payments. As a result, it may force them to list their home as a short sale.

Negative Equity

If a property’s value has declined significantly, the homeowner may owe more on the mortgage than the house is worth. In this case, they have negative equity in the property, and selling it in a short sale is the only viable option.

Inability To Pay Mortgage

Not everyone who lists their home as a short sale is experiencing financial hardship. Some simply lack the necessary funds to pay off their loan balance because of overspending, under-budgeting, or underestimating their payments.

Over-Leveraged

Many homeowners take out more than one loan and use their home’s equity to cover other expenses. When this happens, the risk of falling behind on payments increases. They may have to list their home as a short sale if they cannot keep up with their obligations.

Avoiding Foreclosure and Its Associated Costs

A short sale is often preferable to foreclosure because it’s less damaging to a homeowner’s credit. It’s also less expensive, eliminating late fees, legal fees, and other associated closing costs.

What Are the Benefits of Purchasing a Short Sale Home

Here are the advantages of acquiring a short sale home.

Saves You Money

Short-sale homes are sold at prices below the market price, allowing you, the buyer, to save thousands of dollars. The lender is eager to sell to recover some or all of the seller’s mortgage loan balance. You could have a great deal if you persevere through the long and complicated transaction.

Less Competition

The involvement of the lender complicates the short sale process. Unlike a traditional home sale, there is a lot of paperwork involved, the lender may reject offers, and negotiations can take a long time. As a result, most potential buyers shy away from them, leaving you with fewer competitors.

Potential for Equity

If you purchase a short sale house at a discounted price, you can build equity, as the property’s value may increase over time. Couple this with some improvements, such as repairs, and you can resell it for profit in the future. However, this is not always guaranteed as it’s dependent on the market conditions at that time.

Saves Your Credit Score

A short sale is especially beneficial for sellers facing foreclosure. Unlike the latter, it is less detrimental to your credit score. You can convince the lender to report the short sale as “paid in full” or “settled,” making it easier to qualify for future loans.

Willing Seller

In regular home sales, an angry seller may pose problems such as deliberate property destruction or refusal to vacate. As a prospective buyer, you may be forced to take legal action against them.

On the other hand, a short sale seller is more cooperative, as they’re aware of their dire financial situation and want to avoid the negative implications of foreclosure as much as possible.

The Short Sale Process

While a short sale may sound like a sweet deal, it’s lengthy and complex. Most fall through. To increase your chances of success as a seller, it’s crucial to understand how everything works. Typically, it involves the following steps.

1. Homeowner Seeks the Lender’s Approval for a Short Sale

A financially distressed homeowner voluntarily contacts their mortgage company requesting approval for a short sale. However, it’s not as easy as it seems. To be considered for the approval process, they must demonstrate legitimate financial hardship.

There are various ways they can do this, and include:

A Hardship Letter

The letter explains why you can’t keep up with your mortgage payments. It should provide a detailed, honest, and persuasive account of your financial situation.

For instance, a homeowner who has replenished their savings due to job loss or medical bills has a better chance of success. If, on the other hand, the lender finds that you could pay off the loan by cutting back on non-essentials, the request may be denied.

Evidence of Earnings and Assets

To bolster their case, the seller must provide evidence of their income and assets dating back at least two years—the more recent, the better. This includes pay stubs, tax returns, bank statements, investment accounts, or other relevant documents.

If the lender finds that they have assets they can liquidate to cover the costs, they’re unlikely to approve a short sale.

Comparative Market Analysis (CMA)

The CMA report compares your home to similar properties in your area to determine its market value. In this case, the analysis should only consider those sold in the past six months.

Now, you have to demonstrate beyond a doubt that your home is worth less to offset your original mortgage, and there is no chance of it appreciating anytime soon. Your primary lender might be open to your idea if you can do this.

A List of Liens on Your Property

Lastly, you must provide a list of liens on the property, including second mortgages (home equity loans), unpaid homeowners’ association fees, property taxes, and any other outstanding debts. The lender will consider these obligations to determine if a short sale is feasible.

Once your lender has reviewed all the above documents and is satisfied that your request is legitimate, they may approve the short sale.

2. Homeowner Lists the Property for Sale

The homeowner is solely responsible for selling their property. They may work with a real estate agent or broker to assist. Additionally, the short sale must be disclosed to potential buyers upfront. That way, they’ll know that the home is listed for less than what’s owed on the mortgage

3. Buyer Makes an Offer

Once a potential buyer has been identified, they’ll typically make an offer and submit it to the homeowner. However, it’s contingent on the lender’s approval.

4. Lender Evaluates the Offer

Here is where it gets tricky. The lender must evaluate all aspects of the offer and ensure it’s enough to cover their outstanding loan balance. They may reject it or even make a counteroffer altering the previous terms.

Unfortunately, this can go back and forth for weeks or months until both parties agree. So, this becomes a negotiation between the buyer and lender. However, once the offer is approved, it moves to the closing stage.

5. Closing the Sale

The stage involves the buyer signing the necessary paperwork and paying for the property. The homeowner doesn’t receive any proceeds from the sale, as the lender uses the funds to pay off the outstanding mortgage balance. However, they’re relieved of the entire debt and can avoid a foreclosure auction.

Preparing for the Purchase

As previously mentioned, short sale transactions can be time-consuming and complex. Before making an offer, preparing for the purchase is essential to avoid problems and unexpected delays. Here are some tips:

Keep an Eye for Potential Short Sales

An excellent place to start is by looking for pre-foreclosures in your desired area. You can find these on local public courthouse files, online sale listings, legal ads, or realtor databases.

However, working with a real estate agent experienced in short sales is highly recommended. They understand the local market and can help you navigate the complexities of this transaction.

Research the Property

Once you have identified a few potential properties, do your due diligence. Start by determining the amount of debt on the house compared to its current market value. If it’s high, the seller doesn’t carry much equity in the property, and they’re likely in financial difficulty. That’s a perfect candidate!

Second, visit the property and take a closer look at its condition. Check for mold, rot, water damage, or other possible major repairs. Don’t forget about the neighborhood and see if it fits your preferences. That way, you’ll know what you’re getting yourself into.

Lastly, contact the seller or their experienced agent and inquire whether the house has any liens or other legal issues that may complicate the deal. To be safe, perform a title search before proceeding any further. Remember that having a real estate agent by your side can make this research way smoother.

Obtain a Pre-Approval for a Mortgage

Short sales transactions move quickly. Once an agreement has been reached, the lender may take just a few days (about 20) to close. The last thing you want is to get stuck in a bottleneck due to a lack of finances.

If you have a good credit score, this should be easy. Reach out to your bank or a local mortgage lender and check if you’re eligible for a mortgage. Once you’ve sorted that, you can confidently proceed to the next step.

Making an Offer

First, you’ll require the homeowner’s signed authorization letter to contact the lender and discuss their mortgage situation. Once you’ve got that, you can make a formal offer with your agent’s assitance.

When making one, please consider the property’s market value, condition, and potential for appreciation. Remember, the lender’s motive is to recoup their financial losses as much as possible. Your offer should be competitive but still make economic sense.

However, like any other transaction, you should be prepared for the worse. The lender may reject your proposal or make a counteroffer. Negotiate carefully and be willing to adjust your offer price or other terms to come to a mutually beneficial agreement.

However, if the deal doesn’t favor or make sense to you, don’t be afraid to walk away.

Closing the Deal

After a long hectic, and arduous process, you’re almost done. But don’t celebrate just yet. This stage is crucial; therefore, you should take your time and ensure you understand everything.

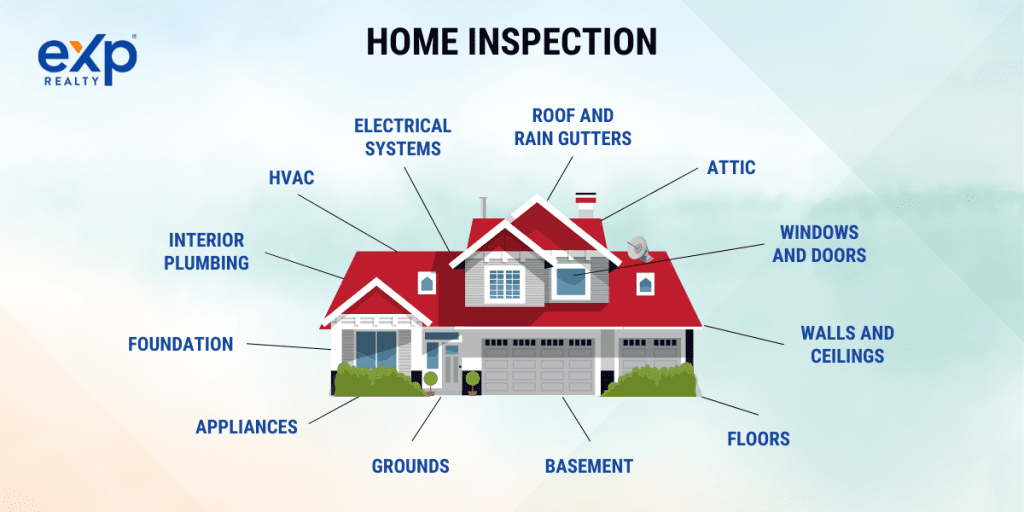

Before closing the deal, conduct a home inspection to identify any potential issues. Most lenders will keep known defects private, which may give the wrong impression of a property’s condition.

Unfortunately, you cannot negotiate a lower purchase price for the property in a short sale if you find any problems. Nonetheless, you can still check for any unpleasant surprises in advance. If you find any repairs, get a cost estimate to see if proceeding with the purchase still makes sense.

Assuming everything checks out, seek the services of a title company. They’ll act as the compliance agent, ensuring your title is free of liens and judgment.

Finalize the purchase! Once you have reached an agreement- you, the lender, and the seller-, it’s time to sign the dotted line and transfer the house ownership to you.

At this point, you’d want to hire an experienced real estate attorney. The complicated legalese in closing documents can be overwhelming and difficult to understand, even for a savvy homebuyer. The attorney will safeguard your rights, review the contract and ensure all parties comply.

Key Takeaways

Buying a short-sale home can be an excellent opportunity to snag a great deal, invest in a good neighborhood, and start building equity. However, you must be prepared to endure prolonged negotiations, the possibility of your offer getting rejected, and a lot of paperwork.

To succeed, ensure you understand what’s required of you, such as doing your due diligence on the property, filing a competitive offer, and getting pre-approval for a mortgage. Additionally, consider working with an experienced real estate agent or attorney who can help you navigate the process.

With patience and determination, this can be a smart financial move. To find short-sale homes and other properties for sale, go to eXp Realty. Start your search today!

FAQs: Buying a Short Sale Home

Let’s look at some frequently asked questions about buying a short-sale home.

Who benefits from a short sale?

In a short sale, everyone benefits. The homeowner avoids foreclosure auctions and, in turn, maintains their credit ratings. Lenders get a chance to recoup a portion of their losses. For buyers, it’s an opportunity for a great deal. They can find properties at a reduced purchase price that would otherwise be out of their reach.

Can you profit from a short sale?

As a potential buyer, you can gain financially from a short sale by purchasing a home for significantly less than the market value. However, the process can be complicated, and various factors can impact your earnings.

For instance, the property may have underlying issues requiring costly repairs or renovations, reducing your potential profit. Additionally, because of the volatile nature of the real estate market, there is no guarantee that you’ll sell the property for a higher sale price later.

Is buying short-sale a good idea?

If you’re a first-time buyer, a short sale may offer you the opportunity to purchase a property at a discounted price. However, you must be patient, do due diligence, and understand the risks involved.

The lender may reject your offer or counter it with an unattractive option. The property is usually sold “as is,” so you’re responsible for any repairs. Still, you can win a short sale with the right strategy and get a bargain price.

What are the pros and cons of purchasing a short-sale home?

Pros

- Lower purchase price: Short-sale homes are usually priced lower than their actual market value, allowing buyers to purchase them at a discount.

- Potential for equity: If the house is well-maintained and its market value increases over time, the buyer may have the potential to build equity in the property.

- Motivated seller: The seller in this transaction is usually in financial distress and, therefore, motivated to sell the property quickly. That gives the buyer more negotiating power.

- Save credit score: The seller’s credit score is not as severely impacted as it would be if the property went through the foreclosure process.

- Less competition: Since short sale applications are time-consuming and complex many buyers are unwilling to participate, giving you a competitive edge.

Cons

- Potential for rejection: The lender could reject your offer if it doesn’t meet their requirements, such as failure to prove financial hardships.

- Lengthy: A short sale involves a lot of paperwork and negotiation, which can take months or weeks.

- Costly repairs: Short sales are sold as-is, meaning the buyer has to make repairs or renovations after purchase.

- Require legal help: Since it’s a complex legal process, you must hire an attorney to guide you through who can add to the overall cost of the sale.

What is a reasonable offer on a short sale?

While short-sale properties are often priced below the market value, you should strive for a reasonable offer. The proposal should consider your financial strength, the property’s condition, the lender’s interests, and the seller’s economic distress.

Conduct a professional appraisal or a comparative market analysis to determine the property’s current fair market value. A good number should be around 90-95% of the property’s market value.

Can you negotiate the price on a short sale?

You can negotiate for a favorable price on a short sale. But first, make sure you understand the interests and situation of the other parties. The lender’s primary goal is to recoup sufficient money to cover the outstanding mortgage debt. On the other hand, the seller may be motivated to accept a lower offer due to their financial hardship.

Also, make sure your agent performs a Comparative Market Analysis (CMA) to determine the property’s current market value and use that as a starting point for your negotiations.

Which is worse, short sale or foreclosure?

Foreclosure is more detrimental to a homeowner’s credit ratings than a short sale. The former entails the mortgage lender seizing and selling the property to recover the outstanding mortgage balance.

It can stay on their credit report for up to seven years, making it difficult to purchase a home in the future. In a short sale, the lender may forgive the actual owner the remaining balance, and they can buy another house sooner.

Why would a short sale be denied?

A short sale may be denied for the following reasons:

- If the seller fails to demonstrate that their inability to pay their mortgage balance is due to financial hardship

- The lender finds or believes the homeowner has assets or sources of income that they could use to pay off their loan

- If the current owner cannot demonstrate that their home is worth less to offset their mortgage, there is no chance of it appreciating soon

- The seller has liens or judgments against the property that could complicate the process

Who has the final say when we have a short sale?

The lender ultimately has the final say regarding the short sale. They hold the mortgage on the property and can approve, reject or make a counteroffer. They’re also solely responsible for negotiations with the buyer and determining the terms and conditions of the sale and any contingencies.