If you’re planning to build a new home or make major renovations to an existing property, you’ll need to know about the different types of construction loans available. Construction loans can be used for new home construction, improvements, and land development. This blog post will discuss the different types of construction loans and what they can be used for. Whether you’re a landowner looking to construct your own house in Florida, or a first-time homebuyer looking for housing options in the Georgia real estate market, knowing the ins and outs of construction loans can save you time and money.

What are construction loans?

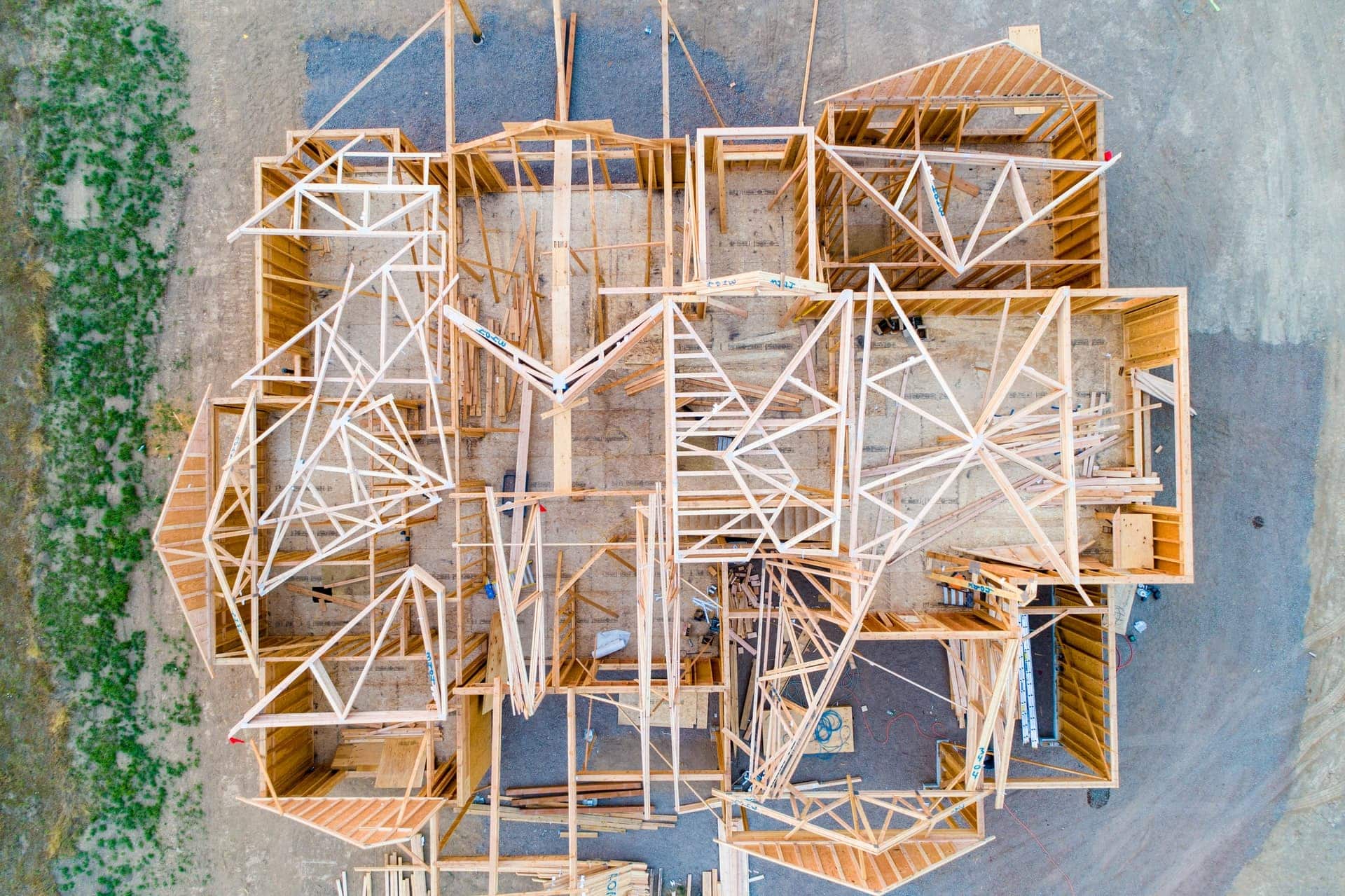

A construction loan is a short-term loan that can be used to pay for the expenses linked with building a house. It’s like your traditional mortgage but with a twist. Loans for developing real estate may cover the expenses of acquiring the land, drawing up plans, obtaining all the permissions, and paying for the workers and the necessary supplies.

You can use a construction loan to get contingency funds if the project is more costly than expected or interest reserves if you want to make interest payments while the work is underway.

How Do Construction Loans Work?

A construction loan provides borrowers with money for materials, labor, plans, permits & fees, closing costs, and contingency and interest reserves to construct their dream home. The land where the house will be located can also be bought with this money. Since this type of loan is designed to cover the construction process, it’s generally issued for between 12 to 18 months.

The application and approval processes for construction loans are more complex than those for a mortgage, and its rates are typically higher than traditional mortgage rates. Unlike conventional mortgages, construction loans aren’t tied or secured to a completed home which means more significant risks for the lenders. The current rates are between 3.25% and 4%.

As a result, the lender will want to review the architectural plans, inspect the builder and your financial situation, and know the projected construction timeline, and the budget before approving you for the loan.

Unlike personal loans, where you receive the funds as a lump sum, construction loans are paid in stages as the home construction advances. In some ways, these loans function as a line of credit. Before each payment, your lender will most likely send an inspector or appraiser to monitor construction progress. You can expect around four to six of these inspections.

In most cases you’ll be required to repay interest on each money sum borrowed—not the whole loan amount. In other cases, the construction loan automatically converts into a permanent mortgage once the building process concludes. An additional alternative is to apply for a mortgage or end loan to pay your construction loan in full.

Types Of Construction Loans

Since constructing a house is not a standardized process, future homeowners should be informed about the types of construction loans available to pick the right one for their specific needs. Before pouring any concrete, let’s learn more about construction loan types:

Construction-To-Permanent Loan

As its name suggests, the construction-to-permanent loan is a type of construction loan that allows future homeowners to borrow money to purchase land and custom-build their home. As the home is built and reaches certain milestones, the lender will often release more money. Once the home is ready, and they move in, that loan transitions to a permanent, fixed-rate mortgage with a typical term of 15 to 30 years.

This type of construction loan is known as “single-close” because you only pay one set of closing costs. These loans are great for homeowners who want predictable interest rates and have simple building plans.

Construction-Only Loan

The Construction-only loan is short-term and covers only what’s needed to complete the construction of the house. Once the building is completed, the borrower must pay the loan in full (commonly in a year or less) or refinance into a mortgage.

Since the potential homebuyers must undergo two application processes and two closings, this type of loan is commonly named “two-close”. The construction-only loans can be beneficial for those who have a lot of cash on hand or plan to use the proceeds from the sale of their previous property to pay off the construction loan.

Renovation Construction Loan

The home renovation loan is excellent for upgrading a home instead of building one from the ground up. The loan might cover the purchase costs of the house (typically a fixer-upper) and the major renovations needed to make it livable.

The amount of money you’ll receive will be based on the home value after all the renovations and repairs have been completed. Unlike the other types of construction loans, the lender usually does not demand information about how the homeowner will utilize the cash.

Owner-Builder Construction Loan

Experienced housebuilders who want to act as their own general contractors can benefit from an owner-builder loan. It is complex to get approval for this type of loan since most lenders might demand the borrower to have proven experience as a builder or licensed contractor. If you satisfy all the requirements, you will receive the payments rather than a third-party contractor.

Construction Loans Basic Requirements

Ready to get your construction project going? As we previously mentioned, the approval process for construction loans is more meticulous than for traditional mortgages and other loans because a home isn’t being used as collateral. You’ll need to meet some financing requirements to get approved for a construction loan.

In addition to conventional lending criteria, most lenders will want to study and approve architectural plans, the proposed construction timeline, and the planned budget. If you want to know more about the basic requirements for a construction loan, keep reading below:

- Good to great credit score and history: As is usual with any lending, your credit score will need to be in perfect condition. To qualify for construction loans, borrowers must have a credit score of over 680. Some lenders might require a 720 or higher score and a proven healthy credit history, though.

- A solid income: Pretty essential requirement that applies to any loan. For construction loans, lenders will request financial verification papers (such as bank statements) to confirm your annual income. This is because you’ll need to prove that you can take care of your existing debts and expenses and still cover the payments of the new construction loan you’re applying for without any struggles.

- Low debt-to-income ratio: Another advantage is having a low debt-to-income ratio (DTI). The DTI compares all your monthly debt payments to your total yearly income. Your DTI should be no higher than 45% to ensure you will be capable of paying off the loan.

- A down payment of 20% to 30%: At least 20% is the standard requirement for construction loans. However, the amount varies by lenders. Some of them require up to 30% of the total construction expenses as a down payment, so it is wise to put your savings in high gear and prepare ahead for this financial scenario.

- Budget Approval: Lenders require as much information as possible about the proposed project and budget because the construction of a house usually involves many variables. Your loan approval chances will increase if you submit documentation like the purchase offer for the land, a detailed line-item budget, complete blueprints and details, an agreed payment schedule, and a signed construction contract with change order provisions.

- Builder Approval: The lender will want to approve the general contractor or builder you are considering for the project. The person or business will need to be qualified, licensed, and insured. Provide the lender with copies of the contractor’s license, insurance certificates, resume, and financial stability evidence. Additionally, include a detailed description of each party’s duties like the architect, contractor, and anybody else involved in the project.

Is a construction loan harder to get than a mortgage?

The answer to this question is a resounding yes. It’s more challenging to qualify for a construction loan than a regular home purchase mortgage. This is because the property has not yet been constructed in most cases and lenders regard these loans as riskier. Additionally, rates and down payments are usually higher for most construction loans than for conventional mortgages.